It’s quite difficult to find a freelancer that provides financial modeling services that are anywhere near accurate. Most of the freelancers on the web are either too expensive to hire or are amateurs who are trying out their freelance financial modeling with your startup.

Let’s discuss where to find the perfect financial analyst and what to look out for.

Financial Modeling Services Types

Financial Modeling is a big world. In companies like Deloitte, the moment they need to model financial projections, for example, there would be a team member for each element. So if we’re talking about financial modeling services, here are the types that you should be aware of:

Projecting an income statement, balance sheet, and cash flow analysis (3-Statement Model).

This is the most common when referring to a financial modeler. The 3-statement model is what each entrepreneurship financial consultant knows by heart. It’s simply stating how much money you’ll be making and losing at each moment in the future. Now the future could consist of 3, 5, or 10 years.

However, the further away the projections are, the less accurate they become.

Projecting a startup’s valuation.

Alternatively, a financial modeler could be projecting your startup’s valuation so that you’d know when is the perfect time to sell your business (or get an investment.)

There are tons of methods to value your business. The most common is the DCF or the discounted cash flow method. However, it highly depends on which stage your startup is in. If it’s pre-revenue, then it’s almost impossible to use this valuation method as it literally relies on your cash flow.

There is another common method for pre-revenue startups known as the scorecard valuation method, which takes into consideration the team, experience, and product compared to a competitor.

Projecting your sales and user growth.

Finally, there is projecting your sales in general as well as your user growth. I don’t believe this is closely related to financial modeling services. This relies on your experience in understanding your target segment.

In which business stage should you consider a financial modeling service?

The further you are in sales, the more the projections are accurate. Hence, the latest you could. If you’re working on an e-commerce shop and you’re sales are doubling each month, why do you need any financial modeling services? It won’t do you any good at this stage.

However, when you’re investing in your business, and your cash flow is getting affected by that, then the answer to knowing how much money you’ll be making is crucial.

For that reason, trying to project financials when the moment is right will go a long way. Usually, my clients approach me for financial modeling services just before raising funds from investors. This makes perfect sense as investors need to be aware of how much money their investment could potentially return.

So let’s say you’re decided to create a financial model; where do you the perfect person to do so?

Where to find a suitable freelancer?

Firstly, can you not do it yourself? Based on my experience, founders of companies are more likely going to create an accurate financial model compared to freelancers or agencies. Why? Because there is no one in this world who knows the business better than them.

Yet, in many cases, time is not your friend, and finding expertise in financial modeling services could mean a do-or-die for your business.

My advice is to head to one of those:

Albusi

Yes, it’s our startup based in Switzerland, and we love it. That’s why it’s my initial recommendation. Our freelancer network on Albusi has created financial models that are for clients who raised over $120 million. So get in touch with your preferred freelancer.

Upwork

Alternatively, you could hire a financial modeler on Upwork. Yet, usually, freelancers there are not vetted. So you need to double-check previous works in order to ensure the quality of the financial modeling services you are going to get. If that freelancer has experience in your industry, that would be a plus.

Fiverr

Finally, Fiverr is quite similar to Upwork. You’ll also need to vet the freelancer yourself. But I’m quite confident that there are many freelancers there who could do the job perfectly.

What should be the result of the financial modeling service?

Alright, so once you hire a freelancer for your financial model, you need to open your eyes to a few vital elements:

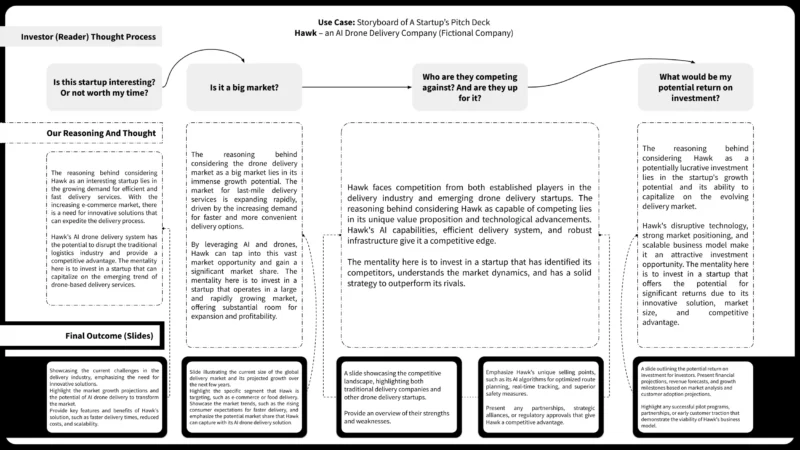

- The explanation of the model: If it’s a very complex model that’s unexplained, the investor wouldn’t be able to understand it. You would lose that investment along with the reason you hired the freelancer in the first place.

- The dynamic aspect of it: As much as possible, remember that you will need to change the model. If changing a number disrupts the whole model, then It’s imperfect. It has to have an assumptions sheet that you could easily change to reflect on the whole model.

- The reasoning behind the projections: You could project making $100 billion in five years if you have a strong reason behind this. So make your reasoning and research crystal clear.

On a final note, if you decided to create a financial model yourself, you’ll find a template here on our website that would certainly help you out. Just open this link and search for “Financial Projections Template”

Best of luck!

Meet The Author Of This Article

I’m Al Anany, the founder and CEO of Albusi.

I love to check out the balance sheets of companies that raised over $120 million and the financial projections of pre-revenue startups. It’s always a joy to watch and learn from.