In the hustle and bustle of everyday life, it’s easy to overlook the critical aspect of managing our finances. We all have dreams and aspirations, whether it’s buying a home, starting a business, or enjoying a worry-free retirement. Having a solid financial plan is the key to turning these dreams into reality.

Another significant benefit of having a personal financial plan is the financial discipline it instills. Through a comprehensive assessment of your income, expenses, assets, and debts, you become more aware of your financial habits. This awareness empowers you to make informed decisions, identify areas where you can save and invest wisely, and develop healthier financial practices.

In this article, we’ll walk you through the importance of a personal financial plan and how a step-by-step template can revolutionize your financial life. So, buckle up and get ready to unlock the secrets to financial success!

Download a Personal Financial Plan Template

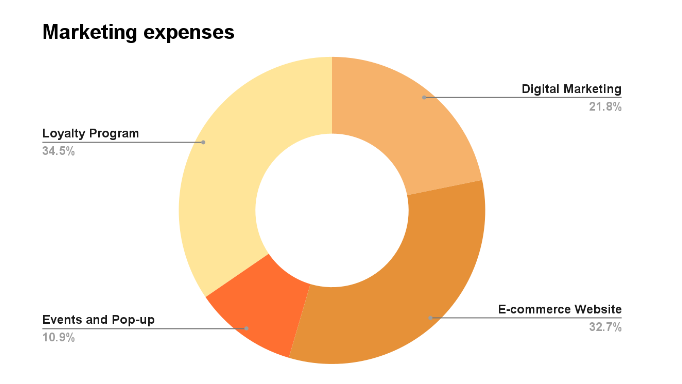

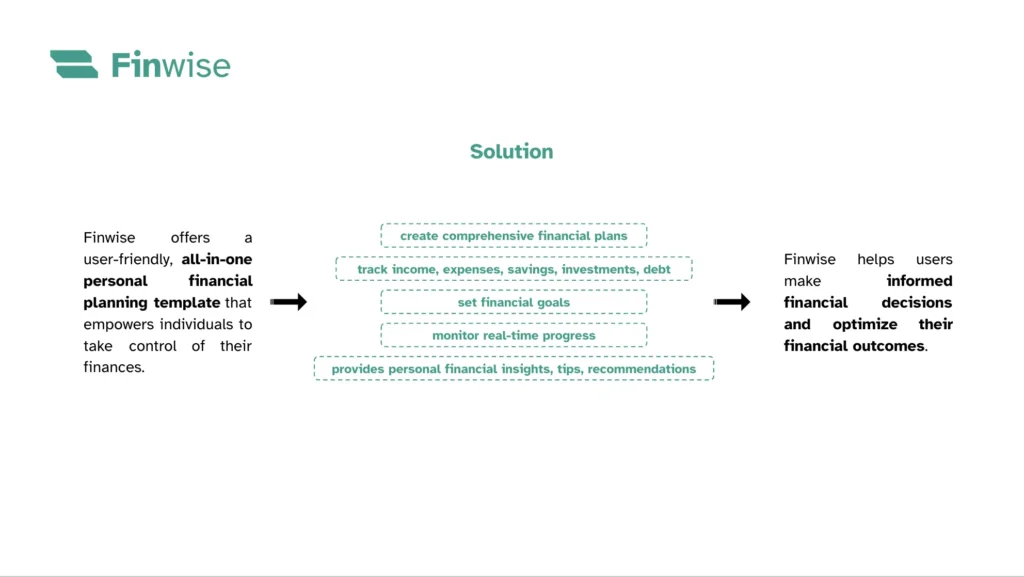

As part of our standard pitch deck preparation, we have prepared a downloadable deck that provides an in-depth examination of FinWise’s approach to financial planning, essential features, market potential, target audience, marketing plan, and financial projections.

*The Albus team offers professionally designed templates of fictional companies that use real content instead of the typical “lorem ipsum” filler text.

Assessing Your Current Financial Situation

To begin crafting your personal financial plan, the first step is to assess your current financial situation. This involves gathering essential information about your income, expenses, and assets. By understanding your financial inflows and outflows, you can gain insights into your spending habits and determine how much you can allocate toward savings and investments.

Next, it’s crucial to analyze your debts and liabilities. Make a list of all outstanding loans, credit card balances, and any other financial obligations you may have. Understanding your debt load helps you prioritize debt repayment and avoid unnecessary interest expenses.

Calculating your net worth is another key aspect of the assessment process. Net worth is the difference between your total assets and liabilities. This figure provides a snapshot of your financial health and can help you gauge your progress over time.

While evaluating your current financial standing, take the time to identify your financial goals and objectives. Determine what you want to achieve in the short, medium, and long term. Whether buying a home, saving for education, or building a retirement fund, setting specific and realistic goals is crucial for effective financial planning.

By thoroughly assessing your current financial situation, you lay a solid foundation for your personal financial plan. This critical step allows you to understand where you stand financially and empowers you to make informed decisions as you move forward with the rest of the planning process. Remember, knowledge is power, and the more you know about your finances, the better equipped you’ll be to shape a successful financial future.

Setting Specific Financial Goals

In creating your personal financial plan, setting specific financial goals is a critical step toward success. These goals act as the driving force behind your financial decisions, motivating you to stay on track and achieve your dreams.

Start by categorizing your goals into short-term, medium-term, and long-term objectives. Short-term goals typically cover one to two years, such as building an emergency fund or paying off a small debt. Medium-term goals span two to five years, encompassing aspirations like saving for a down payment on a house. Long-term goals extend beyond five years, focusing on retirement planning and other significant milestones.

To prioritize your goals effectively:

- Consider their urgency and importance.

- Determine which goals are time-sensitive and require immediate attention.

- Simultaneously, evaluate the impact of each goal on your overall financial well-being and identify those that hold the highest significance.

To make your goals more achievable, ensure they are measurable and specific. Define each goal with a clear target amount or a specific timeline. For instance, rather than saying “save for retirement,” specify how much you want to save each year or by what age you aim to retire.

Additionally, align your financial goals with your personal values and aspirations. Think about what truly matters to you and what you envision for your future. By aligning your goals with your values, you’ll find greater motivation to work towards them and enjoy a more meaningful financial journey.

Remember, setting specific financial goals provides the direction and purpose you need to navigate your financial plan successfully. Keep these goals in sight, review them regularly, and adapt them as your circumstances change. With clear objectives in place, you’re better equipped to build a solid foundation for your financial future.

Personal Financial Plan: Creating a Budget

A fundamental aspect of your financial plan is crafting a budget. Budgeting is the cornerstone of sound financial management and empowers you to take control of your money. Here’s why budgeting is essential in your financial plan:

Importance of Budgeting in a Financial Plan: Budgeting provides a clear picture of your financial inflows and outflows, accurately assessing where your money is going. It acts as a financial roadmap, guiding you toward your goals and preventing impulsive spending that could derail your progress.

Tracking and Categorizing Expenses: To create an effective budget, start by tracking and categorizing your expenses. Monitor your spending patterns over a defined period, whether monthly or annually. Categorize expenses into essential (e.g., housing, utilities, groceries) and discretionary (e.g., dining out, entertainment) to identify areas where you can make adjustments.

Allocating Income for Essential and Discretionary Expenses:

- Once you clearly understand your expenses, allocate your income accordingly.

- Ensure that essential expenses are prioritized to meet your basic needs.

- After covering essentials, allocate a portion of your income for discretionary spending, but be mindful not to exceed this amount.

Tips for Sticking to the Budget: Sticking to a budget can be challenging but is essential for financial success. Here are some tips to help you maintain budget discipline:

- Set realistic spending limits for discretionary expenses.

- Use cash or digital tools to track expenses in real-time.

- Review your budget regularly and make adjustments when necessary.

- Consider automating savings and bill payments to avoid late fees.

- Stay disciplined but allow room for occasional treats or rewards.

Budgeting lets you make intentional decisions, save for your goals, and avoid unnecessary debt. Remember, a budget is not about deprivation; it’s about aligning your spending with your priorities and ensuring financial stability for the long term.

Personal Financial Plan: Managing Debt

Debt can be a double-edged sword, so it’s essential to handle it wisely. Begin by evaluating the various types of debt you carry, like credit cards, student loans, or mortgages. Understanding the interest rates and terms helps you prioritize which debts to address first.

Explore effective strategies for debt repayment, such as the snowball or avalanche method. Whether you tackle smaller debts first or focus on high-interest ones, finding a plan that suits your situation is crucial.

While repaying debt is vital, remember to balance it with other financial goals. Allocate funds for savings and investments alongside your debt repayment plan. Finding this equilibrium ensures progress toward both financial freedom and long-term aspirations.

Lastly, steer clear of common debt pitfalls. Avoid accumulating unnecessary debt, and strive to live within your means. Be mindful of impulse purchases and prioritize needs over wants. By managing debt responsibly, you pave the way for a healthier financial future.

Personal Financial Plan: Final Thoughts

A personal financial plan is pivotal in achieving financial stability and success. Throughout this article, we’ve explored the importance of having a well-structured financial plan and how it can positively impact your financial journey.

By analyzing your current financial situation, you gain valuable insights into your income, expenses, assets, and debts, enabling better financial decision-making. It acts as a tool for risk management. It helps you prepare for unforeseen circumstances by creating emergency funds and securing appropriate insurance coverage.

Remember that a financial plan is not set in stone. As life evolves, your goals and circumstances may change, so reviewing and adjusting your plan is essential.

In conclusion, taking action and using the step-by-step template in this article can set you on the path to financial empowerment. With a carefully crafted financial plan, you’ll have the tools to make informed decisions, prioritize your goals effectively, and work towards a more secure and fulfilling future. Embrace the power of financial planning and enjoy the peace of mind of taking control of your financial well-being.

Meet The Author Of This Article

Hi! I’m Elsa

I’m a Growth Marketer specializing in supporting small to medium-sized companies to thrive.

I focus on brand, business, and team growth to drive accelerated success.

Currently, I leverage content creation to share my personal growth journey and expertise.