In the crazy world of startups, getting money from investors is super important. It can either make or break an entrepreneur’s journey. But figuring out the differences between investor deck vs pitch deck can be a real headache. As a business consultant who’s been around for over 12 years, I’m going to shed some light on the small details that can make all the difference when you’re trying to get funded.

See, these days, it feels like at least 30% of the internet is written by AI. So us humans, we’re a rare breed. That’s why I’m here to share my expertise and help you crush it when it comes to fundraising.

If you ask any reasonable human being, the answer is very easy. There are no differences between “investor deck” and “pitch deck”. They’re synonyms.

But why are they associated differently? Here we go.

What is an Investor Deck?

The Comprehensive Nature of Investor Decks

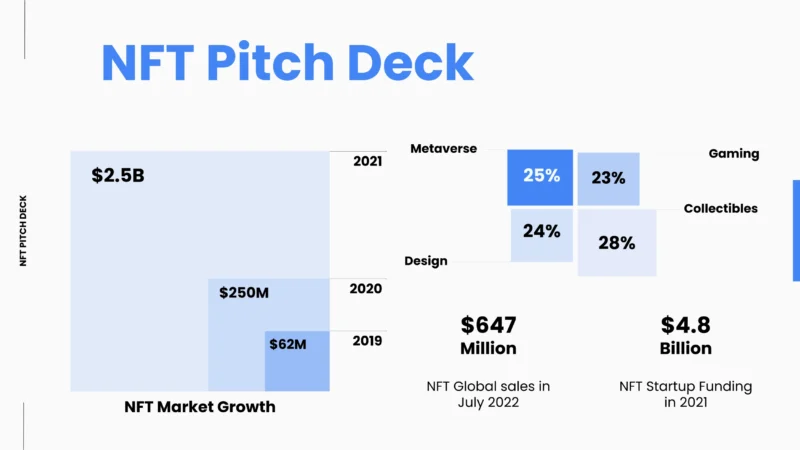

Investor decks, also included in “data rooms” or “virtual data rooms,” are these super detailed documents that go really deep into your business. They’re usually longer and more thorough than pitch decks, around 40 pages or more. The goal is to give investors a full understanding of your financials, operations, market position, and growth potential.

Think of it this way – an investor deck is like that thick binder you had to bring to every job interview back in the day. It’s got everything the investor could possibly want to know about your company, from top to bottom.

Typical Content and Structure of Investor Decks

Investor decks cover a ton of ground, like:

- Executive summary – This is the quick high-level overview to hook them in.

- Company overview and mission – Who you are and what you’re all about.

- Product or service details – Get into the nitty-gritty of what you’re offering.

- Market analysis and opportunity – Show them the massive potential.

- Competitors – Gotta prove you can outshine the other guys.

- Detailed financial projections – Break out the spreadsheets and crunch those numbers.

- Management team and advisors – Introduce your all-star lineup.

- Future plans and milestones – Map out where you’re headed.

- Funding needed and how you’ll use it – Tell them how much you want and where it’s going.

- How investors could make money (exit strategy) – This is the big one, how they’ll cash out.

This deck is meant to answer all of an investor’s questions during the due diligence process before they decide to invest. It’s like an open book exam – you want to make sure you cover everything.

What is a Pitch Deck?

The Concise and Compelling Pitch Deck

On the other hand, a pitch deck is a shorter, more visual presentation that introduces your startup to investors. It’s usually 10-15 slides, designed to grab investor attention and give them the key info about your business.

Think of the pitch deck as your elevator pitch on steroids. You’ve got just a few minutes to hook them and make them want to learn more.

Typical Content and Structure of Pitch Decks

A good pitch deck typically covers things like:

- The problem you’re solving and market opportunity – What pain point are you addressing, and how big is the market?

- Your product or service – Give them the highlights of what you’re offering.

- Your competitive advantage and value proposition – Why should they choose you over the other guys?

- Your target customers and go-to-market plan – Who are you selling to and how will you reach them?

- Traction and milestones you’ve hit – Any early signs of success to showcase?

- Financials and revenue model – Keep it high-level, but show them the money.

- Your team and key advisors – Introduce your all-star crew.

- How much funding you need and how you’ll use it – Be specific about the investment you’re looking for.

- Your potential for investors to make money (exit strategy) – This is what they really care about.

The pitch deck is all about getting investors excited to learn more, so they’ll dig into your full investor deck or want to chat further.

Startup Stages of Investor Deck vs Pitch Deck

Investor Decks for IPOs and Series D+

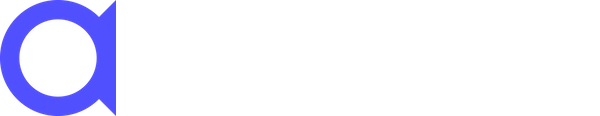

As startups mature and start thinking about going public (IPOs) or raising big Series D+ rounds, the focus shifts more to that comprehensive investor deck. These established companies have tons of financial and operational data to share, so investors need all the details before writing a big check.

I’ve worked with a few companies like that over the years, and let me tell you, their investor decks make my 40-page pitch decks look like child’s play. We’re talking presentations that could double as a small novel. But that’s what the big-time investors demand at that stage.

Pitch Decks for Seed, Pre-Seed, and Series A

Early-stage startups going after seed, pre-seed, or Series A funding tend to rely more on the classic pitch deck. These short, compelling presentations are designed to capture the essence of the business, highlight the problem you’re solving, and show investors your growth potential – all while keeping their attention.

When you’re just getting off the ground, you don’t have a decade’s worth of financial statements and operational data to dump in an investor’s lap. That’s where the pitch deck shines – it’s your chance to tell a killer story and get them hooked.

I’ve worked with tons of founders in those early stages, and let me tell you, crafting the perfect pitch deck is an art form. But nail it, and you’ll have investors lining up to learn more.

Investor Deck vs Pitch Deck: 40 Pages vs. 12 Slides

Investor Decks: Comprehensive Financial and Business Info

They are the comprehensive documentation of your business, covering everything from financial projections to operational plans to market analysis. At 40+ pages, they give investors all the nitty-gritty details they need to really understand your venture’s long-term potential.

It’s like building a house – the investor deck is the complete set of blueprints, permits, and construction specs. Everything an engineer or inspector could possibly want to know.

Pitch Decks: Distilling the Essence for Investor Attention

Pitch decks, on the other hand, are meant to be more concise, usually 10-15 slides. The goal is to boil down the core of your business in a way that captivates investors and makes them want to dig deeper into your investor deck or talk to you more.

The pitch deck is more like the glossy brochure you’d use to sell that same house. It’s got the key selling points, the must-see features, and enough to get them excited about taking a tour. But the real nitty-gritty is in that monster investor deck.

Tailoring Your Deck to the Audience

When you’re putting together your investor or pitch deck, you gotta keep in mind how investors think. They’re swamped with funding requests, so they need info that quickly shows them your market potential, competitive edge, financials, and awesome team. Give them what they’re looking for.

Investors are a tough crowd – they’ve seen it all. But if you can demonstrate that you understand their needs and speak their language, you’ll be way ahead of the pack.

By tailoring your deck to the specific investors you’re targeting, you’ll have a much better shot at grabbing their attention and getting them to invest. You might highlight different aspects or adjust the level of detail depending on the startup stage and investor type.

For example, if you’re pitching to a VC that specializes in early-stage tech, you might lean harder into your innovative product and growth potential. But if you’re presenting to a family office that focuses on consistent cashflow, you’d probably want to emphasize your financials and business model.

The Art of Storytelling: Connecting with Investors

Even though investor decks are super comprehensive, you still gotta tell a good story with them. The best ones weave all the business elements together in a compelling narrative that lets investors visualize the potential of your company.

It’s like that old saying – facts tell, but stories sell. You want to take all those nitty-gritty details and turn them into a captivating tale that gets investors excited about where you’re headed.

With pitch decks being so concise, nailing the storytelling is even more crucial. The top pitch decks use visuals, data, and tight messaging to create a captivating narrative about the problem you’re solving, your unique solution, and your growth potential. This gets investors hooked and eager to learn more.

Think of it this way: Your pitch deck is your chance to give investors a movie trailer for your business. You want to tease the key highlights, build some suspense, and make them say, “Whoa, I gotta see the full-feature film!”

Verdict – investor deck vs pitch deck

In this crazy startup funding world, understanding the small differences between an investor deck and a pitch deck is key to success. Whether you’re going after seed money or preparing for an IPO, tailoring your deck to exactly what your target investors want can make all the difference.

But the most important point is to actually go for it. Even if you name your document cheese deck.

As an experienced business consultant, I’ve helped tons of startups through fundraising, and I’ve seen firsthand how much impact a well-crafted deck can have. By embracing these nuances and honing your storytelling, you can position your startup for funding victory and bring your vision to life.

Remember, fundraising isn’t just about numbers and details – it’s about connecting with investors, inspiring them with your big idea, and showing them the crazy potential of your business. So take the time to make a deck that really resonates, and enjoy the ride as you navigate the startup funding world.

Go download one of our free pitch deck (or investor deck) templates from here.