Accounting For Startups – For Dummies.

I’ve been consulting startups for 12 years now. Let’s start with the easy part when it comes to accounting for startups. In some places around the world, if you’re running a startup, the law asks you to keep track of your numbers and report them. That’s accounting for you. But here’s the thing, while it might seem like a bit of a chore, understanding the basics of how your business makes money, and where it might be losing cash, is super important. It’s not just about ticking boxes for legal reasons.

Think about a restaurant. At the end of the day, it needs to make more money than it spends on ingredients, staff, and keeping the lights on. A startup is no different. You’re in the game to eventually make a profit. It’s about knowing whether you’re moving in the right direction. And for that, you don’t need to dive deep into complex accounting from the get-go. What matters is getting a good grasp on the basics – how much money is coming in and going out.

Understanding this flow of money is like knowing the score in a game. It tells you if you’re winning or if you need to change your strategy. And just like in a game, the basics can get you pretty far. It’s about spotting when the cash register sings and when it’s a bit too quiet. This simple awareness can be a game-changer. It’s your early warning system, signaling when to celebrate and when to huddle down and rethink your plan.

But let’s not forget, while keeping an eye on the present, planning for the future is just as important. This is where a budget comes into play. A budget is like a map for your startup’s financial journey. It helps you set goals — like opening a new branch of your “restaurant” or launching a new product. And just like any good map, it needs to be checked and adjusted as you go along. The road to success is full of twists and turns, and your budget needs to be flexible enough to handle them.

The Financial Model Template

Now, keeping an eye on your startup’s finances doesn’t have to be a headache. There’s something that can make life a lot easier: a financial model template. Think of it as a tool that helps you keep track of your money, making sure you’re not spending more than you’re earning.

We’ve created a free template that could be a good starting point for you: Subscription Financial Model Valuation Google Sheets. This isn’t just a one-and-done kind of deal, though. The real magic happens when you keep this model updated. It’s like having a health check-up for your startup’s finances. The more regularly you do it, the better you’ll understand your business. And understanding your business’s financial health is crucial, especially in the early days.

What makes a good startup financial accounting model?

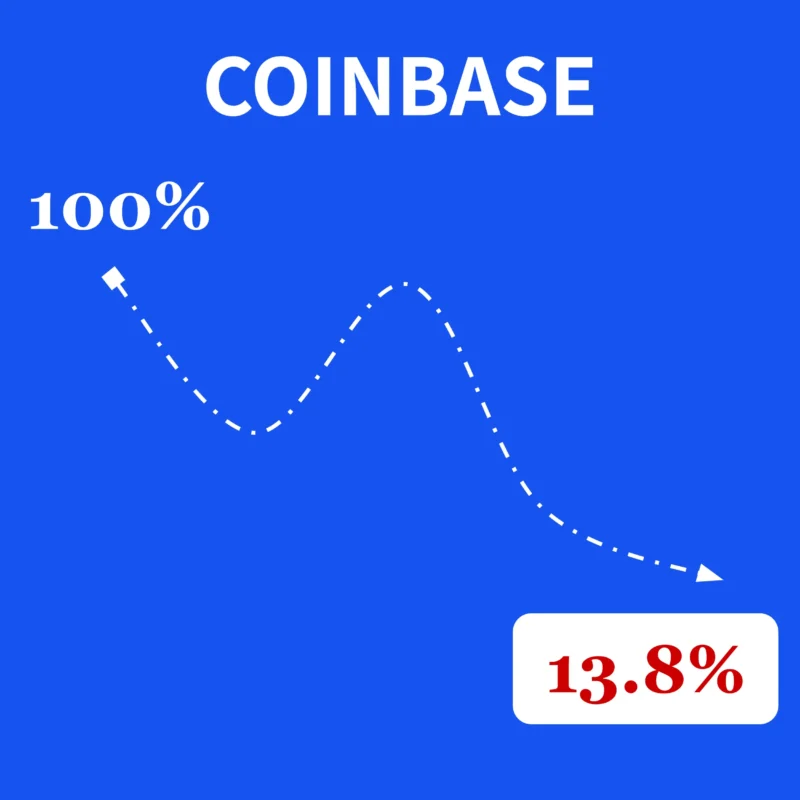

A solid financial model reflects your business’s reality as closely as possible. It’s not just about projecting your future income or expenses but also about understanding the ‘why’ and ‘how’ behind these numbers. This means incorporating real-world variables and assumptions that impact your business, from market trends to customer behavior.

Moreover, a good financial model is always evolving. As your startup grows, the model should grow with you, adapting to new information, challenges, and opportunities. It’s a tool that requires regular refinement and adjustment. Think of it as gardening; you can’t just plant seeds and hope for the best. You need to water them, prune them, and sometimes even replant them to ensure they flourish.

One of the key benefits of adopting accounting for startups is risk management. It allows you to play out ‘what if’ scenarios, helping you prepare for possible future challenges. What if a new competitor enters the market? What if there’s a sudden change in customer demand? By tweaking your model, you can see potential impacts on your finances and plan accordingly.

Another aspect is the strategic value it offers. With a clear view of your financial trajectory, you can make informed decisions about where to allocate resources. It helps you identify which areas of your business are thriving and which might need a bit more attention or a different strategy.

But perhaps the most compelling reason to adopt and regularly update your financial model is the confidence it gives you. When you understand your startup’s financial landscape, you’re better equipped to pitch to investors, secure loans, or make pivotal business decisions. It’s like having a map in unknown territory; it doesn’t make the journey less challenging, but it does make it less daunting.

Startups & The Need For Accounting

In the early days of your startup, it’s all about the thrill of building something new and making your customers or users happy. You’re chasing that dream, fueled by passion and maybe a bit too much coffee. In this whirlwind, you might wonder, “Do I really need a Chief Financial Officer (CFO) right now?”

Here’s the deal. A CFO is super important when it comes to accounting for startups, but there’s a right time for everything. In the beginning, your focus should be on your product or service and getting it into the hands of happy users. The need for a dedicated CFO comes a bit later, once your startup begins to grow and the financial decisions get more complex. That’s when having someone with expertise in managing finances can really help steer your startup towards long-term success.

At the start, it’s all about that initial excitement and connection with your customers. Make them happy, and you’re on the right path. As your startup grows, the complexity of managing finances will too, and that’s when you’ll know it’s time to bring in a CFO to help navigate those waters.

By keeping things simple at the start and focusing on the core of your business, you’re laying the groundwork for success. And remember, whether it’s using a financial model template or deciding when to hire a CFO, the key is to stay flexible and adaptable. After all, the journey of a startup is rarely a straight line.

Your Financial Focus

But in general, accounting for startups is something for down the road; when things start getting big, the money stuff gets trickier. That’s when a CFO can really make a difference, helping guide your startup to even greater things.

As things kick off, it’s the vibe and the connection you build with your customers that count the most. Keep them smiling, and you’re golden. But as your startup grows, so does the pile of financial decisions waiting to be made. Suddenly, you’re not just thinking about the next big idea or how to make your users happy. You’re thinking about budgets, investments, and maybe even how to deal with big money questions. That’s CFO territory.

Bringing in a CFO at the right time can feel like getting a superpower. They know their way around numbers like nobody’s business. They can help you figure out if it’s the right time to spend, save, or maybe even chase after more funding. It’s not just about keeping track of dollars and cents; it’s about making smart moves that keep your startup healthy and heading towards success.

Remember, in the beginning, it’s all about laying a solid foundation. Focus on what you’re good at and what you love doing. But keep an eye on the future, too. Being ready to adapt and grow is part of the journey. When your finances start getting more complex, and you need someone to help steer the ship, a CFO can be your navigator, helping you dodge the icebergs and catch the tailwinds.

So, keep it simple for starters, concentrate on what matters most—your product and your customers. This is what lights up the path ahead. And when the time comes that the financial seas get choppy, you’ll know it’s time to bring on a CFO to help chart the course. Until then, enjoy the ride, keep learning, and stay nimble. After all, every big adventure has its twists and turns, but that’s what makes the success story so worth telling.