Firstly, I Use Coinbase.

Before you start saying, “Oh, he’s a Coinbase hater.” or “He his not a crypto supporter.”, I constantly use Coinbase in my transactions. Additionally, I specialize in crypto and blockchain projects. It’s a vital detail to know before reading this article, which is mainly a risk analysis of why you should change your crypto exchange if you are on Coinbase. Although let me start by also saying that the Coinbase success story is wonderful as a tale.

Coinbase is a massively successful company. However, I am a believer that this is coming to an end. If that happens, it will be messy, and I am advising you to dodge a bullet possibly. This is based on the simple concept of better safe than sorry.

Do not let this change your perception of cryptocurrency whatsoever. I strongly believe crypto is a crucial asset with its surrounding tech in changing the future. So, let’s talk about the Coinbase success and how it could fall similarly to the widely famous FTX.

Coinbase started from the bottom, literally.

Even though Binance is probably more successful than Coinbase, it started in 2012. That’s when the bitcoin price was $13 (Yes, you read that right.)

To build a giant startup based on such an asset was a risky move back then. Yet, it paid off. They used this pitch deck to raise funds and turn their startup into what it is today. They raised a total of $573.7 million, which is impressive.

But, if raising funds is impressive, then FTX would not have been a disaster. Remember, FTX raised over $1.8 billion dollars. But we will circle back to this later in this article.

They did something that many crypto believers criticized and thought was out of the ordinary.

The average timeline of a standard crypto firm.

- Create an MVP using crypto.

- Let people use your product and make the transactions, obviously, in cryptocurrency.

- Then when you grow enormously and want to be a public company, then go through an ICO (Initial coin offering.)

- Keep promoting the use of cryptocurrency; without it, you will fail.

For instance, if you believe in Binance as a startup, then you will probably buy lots of BNB (Binance coin) through Binance itself. Then watch the price fluctuate. If you actually did that in April 2021, you would have 50% of your investment right now (remember this.)

What did Coinbase do, though? They went on to do an IPO (Initial Public Offering). This simply means that any person could purchase stocks of Coinbase as a company with their normal currency, like the US dollar. It has nothing to do with cryptocurrency and is highly regulated as it means that they have to now release their financial performance each quarter to the public. This outraged some bitcoin believers. It did not vibe well with Bitcoin believers when the Coinbase pitch deck had a slide titled, “Coinbase: A New Payment Network”

The IPO was not a good idea.

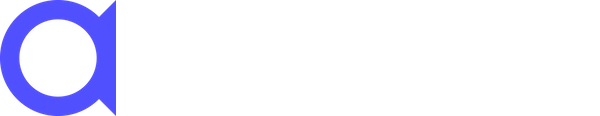

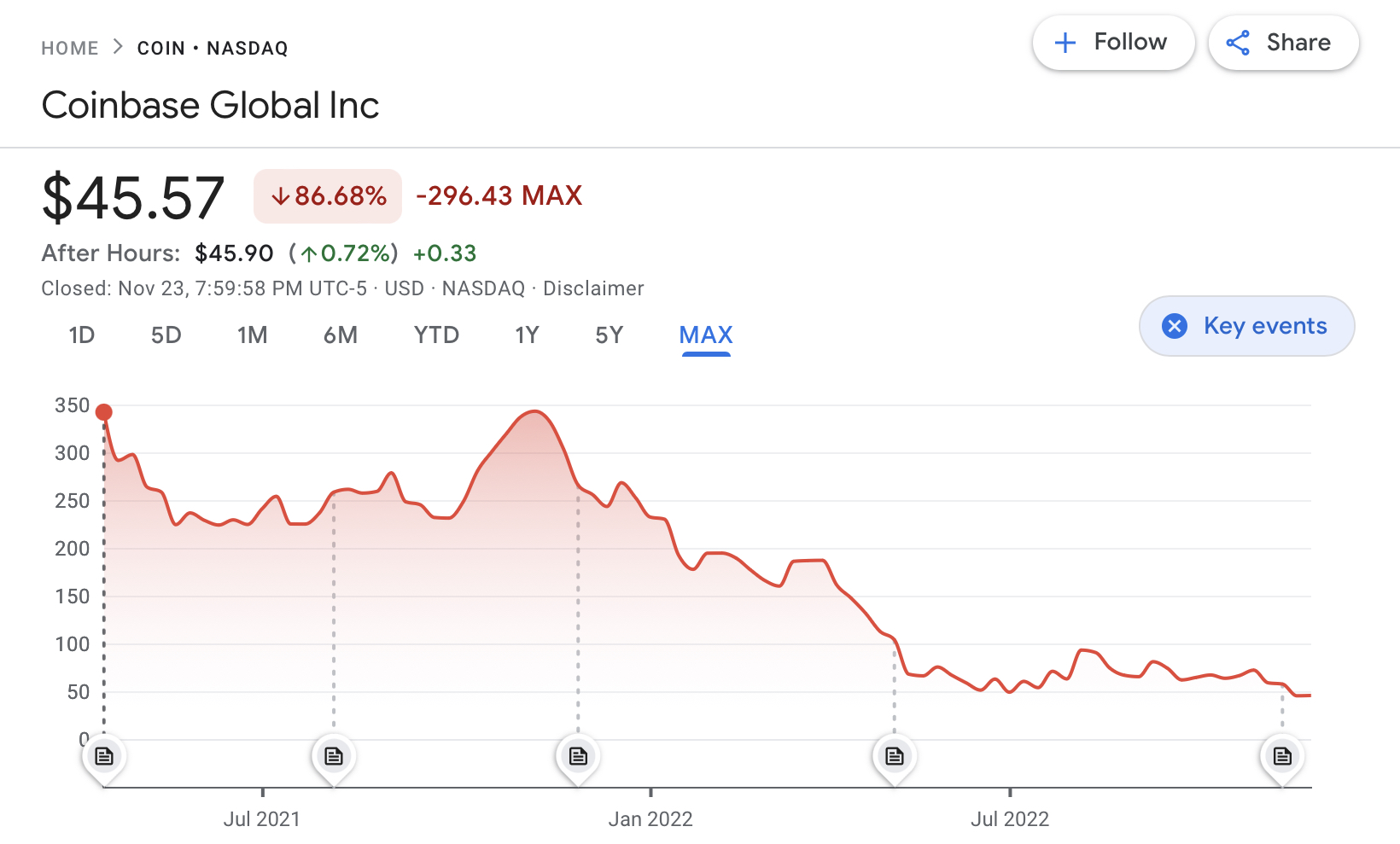

Remember when I told you that if you invested in the Binance coin, you would’ve lost 50% of your investment? If you had invested in Coinbase when they launched their IPO, you would’ve lost a whopping 86% of your investment.

This makes extreme sense. Let me tell you why.

- For BNB or Crypto in general, the fate of the price lies with the people buying and selling cryptocurrency. Some are experimenters, but some are hardcore believers who won’t sell no matter what.

- For Coinbase, the fate of their stock lies with the people who believe in crypto but not as much as hardcore believers. So they will leave Coinbase if they believe it’s drowning. Additionally, even if they believe in crypto, this had transformed when they invested in Coinbase to them believing in Coinbase, not cryptocurrency.

A closer financial look to assess the Coinbase Success.

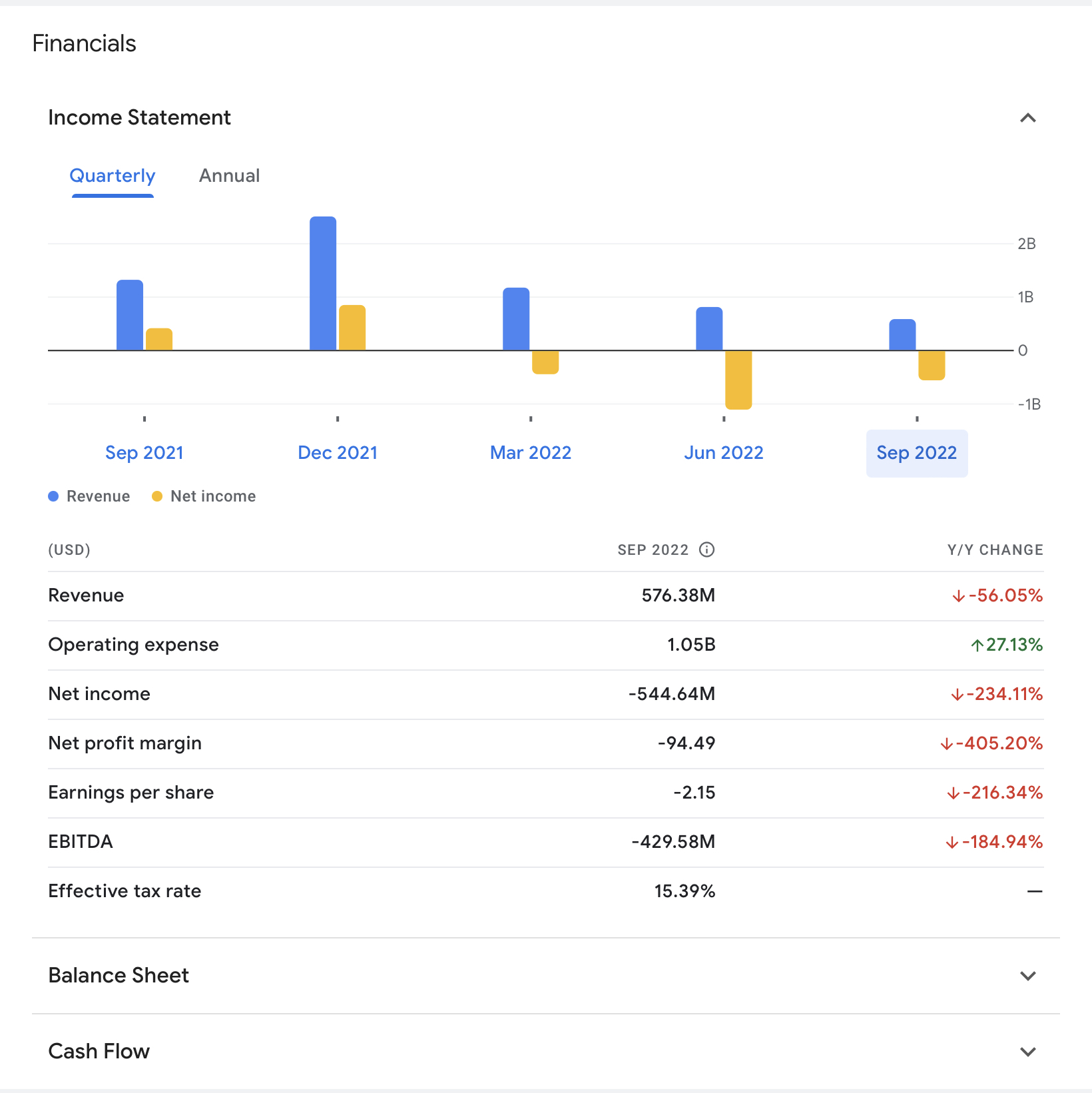

I mainly wanted to try to understand why their stock is dropping massively.

You have to keep in mind that the world is in a recession, and everything is dropping (But definitely not 86%.)

So I looked at their performance for the past year. They’ve shown revenue and profit in two quarters. Then the revenue is in decline, as we as the profit. This, again, makes sense because of the recession.

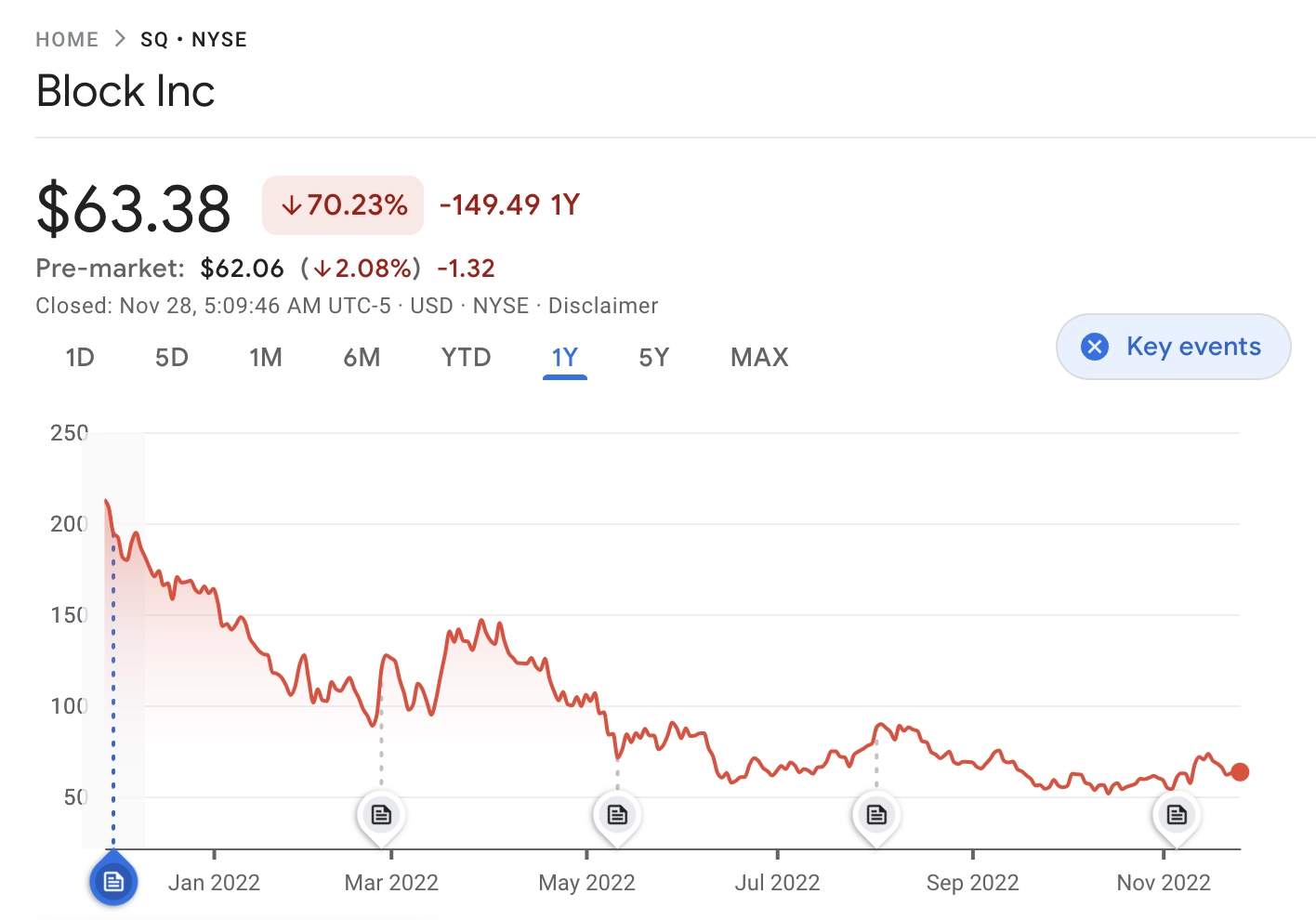

But the core concept of relying on the overall market rather than the crypto market is not vibing well with their stock, believers, or their financials. Actually, to make it more sensible, let’s compare the performance of Coinbase with another startup that had an IPO at a similar time.

Finally, Let’s compare it with other fintech companies’ performances.

It’s all a sad sea of red. Yet, ironically, a crypto coin like BNB (Binance coin) is the least injured.

But what does this have to do with FTX?

FTX gambled hard, but Coinbase can‘t.

That’s the price you pay for being a public company with an IPO. You have to be an open book (more or less.)

The reason why FTX was a shock to the whole world is that no one expected it. They were a private company and had no reason to tell the world what they were spending money on. Hence, the world is a little shocked to know that Sam Bankman-Fried was spending massive amounts on luxury items.

So that’s actually an advantage when it comes to Coinbase. You can review their financials yourself and see whether they’re overspending while losing. But remember, FTX was a widely successful company.

FTX success compared to the Coinbase success.

They’ve raised a whopping $1.8 billion from investors. They got the support of people like Tom Brady and the famous investor Kevin O’Leary (Mr. Wonderful).

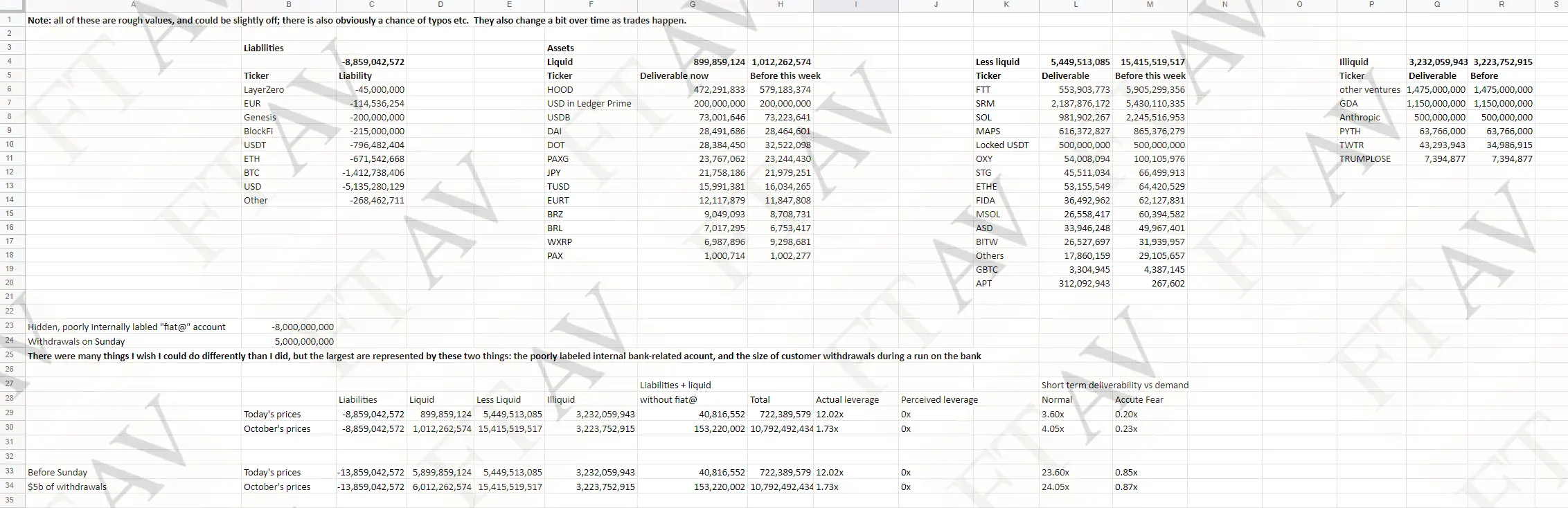

Then the world collapsed around them, and they released their financials when they declared bankruptcy.

Their crypto coin FTT went from $1.7 to $80, which is a crazy 47X of the initial amount. Then after the bankruptcy, it collapsed to $1.3. But the real problem is that people can not withdraw their funds as they’re missing.

So FTX screwed up due to bad management. Let’s say Coinbase does not have that.

Coinbase’s success relies on investor sentiment.

That is the core problem with you using Coinbase right now. It’s not relying on the actual crypto market. A single big investor withdraws money from there, and you have yourself public fear and a good stock drop. This exists in cryptocurrency. But unlike the Coinbase stock, Bitcoin’s price depends on a bigger majority of people.

So all it needs is a single touch of fear. For instance, a piece of news like this one or a big investor like Cathie Wood changing her mind about Coinbase. This will result in an instant downfall. Yet, at the moment, she’s actually investing more in Coinbase.

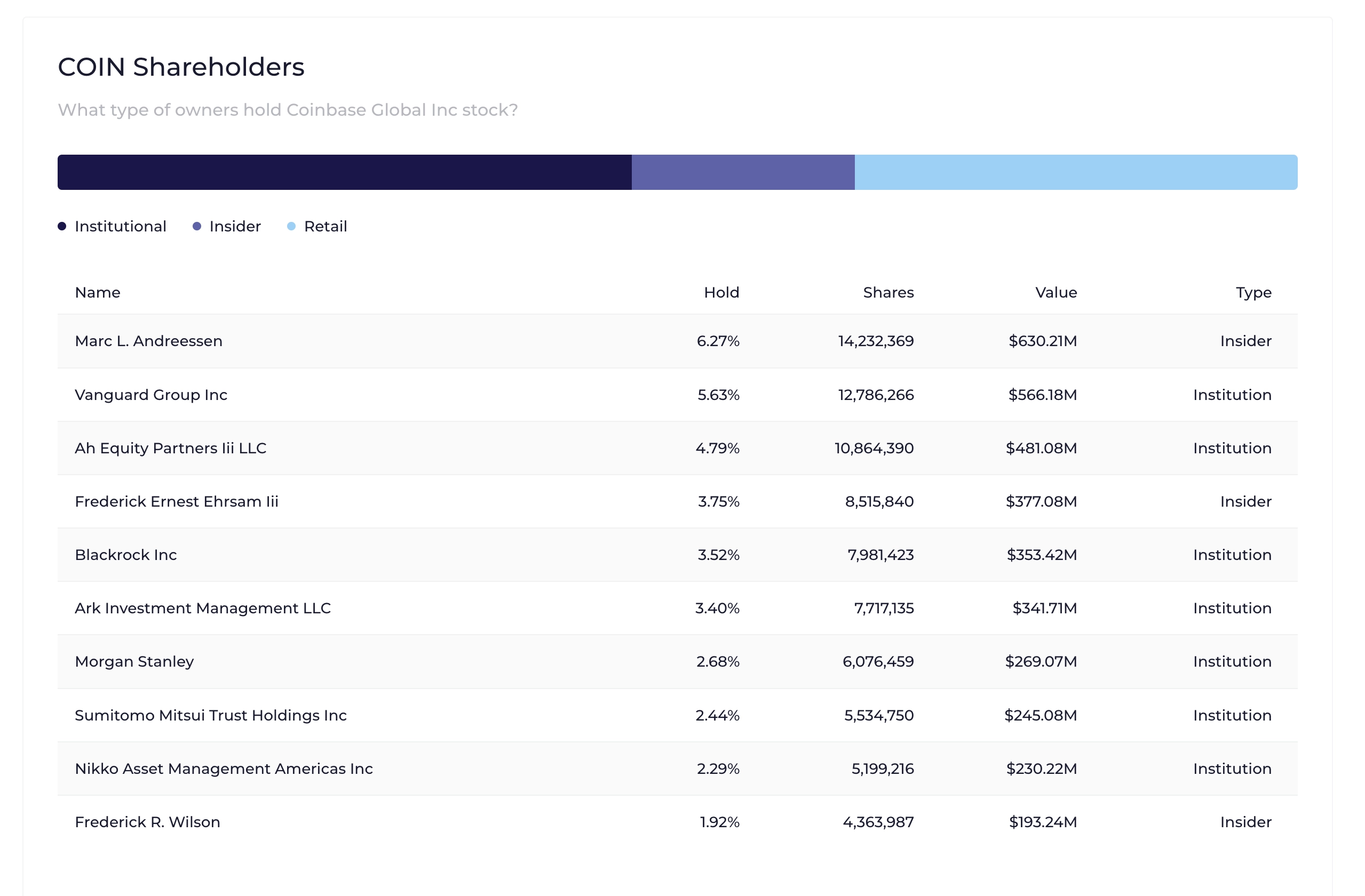

The graph above shows how much everyone owns from Coinbase. Retail, which is another word for the public, has around 35%. Compared to Bitcoin, for instance, it’s limited. That 35% are investors who usually invest in the stock market. They do not have the same sentiment as the 190 million Bitcoin users in the crypto market.

Better safe than a slow death of the Coinbase success.

So given the variables:

- The world is in a recession.

- The fate of Coinbase relies on just a handful of people (who are not hardcore crypto supporters.)

- Their stock is underperforming massively.

- Triggers like: FTX’s collapse and their recent $1.5 billion withdrawal on Nov. 24th and 25th.

I would not be surprised if a company-wide press release forcing users not to withdraw their funds is backed up by some user agreement term. At that moment, you might have to refresh the price of the stock of Coinbase every day and hope that firms like Vanguard and Cathie Wood’s ARK would not back down.

Finally, remember, if Coinbase fails, the world moves on. Coinbase is a startup like any other in the world of crypto. The crypto world could show a decline, but it will always rise.

Meet The Author Of This Article

I’m Al Anany, the founder and CEO of Albusi.

Writing in the business industry has shifted my mentality toward entrepreneurship. I started on Medium in 2021 and ended up being a Top Writer of more than 4 categories and had my content viewed more than 213k times.

I always have a single goal while writing: focus on entertaining while adding value.