Rental property businesses can be a tremendously profitable and rewarding idea for entrepreneurs. Diversifying the investment portfolio and creating a passive revenue stream are clear reasons the rental property can be your next go-to source of income. But, to rent out your first property, you must understand how to start a rental property business to position yourself in the market. Also, to give you an extra push to the business, we have prepared an easy-to-access-and-read investor deck template.

Let’s dig into this more.

Download the Rental Property Business Pitch Deck (in Google Slides)

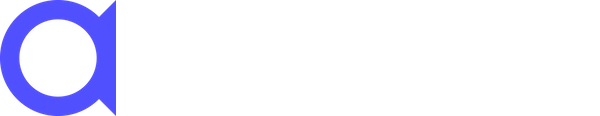

Homestead is our Real-Content Template (RCT) invention for your rental business. Albusi has developed and designed an RCT to access an appealing investor deck. It’s a merge between an actual pitch deck and a template.

You can easily access the rental property business investor deck through the link below.

However, I strongly encourage you to read through the coming lines to master the use of the template. To put it differently, what’s the use of a template if you don’t have the know-how about the industry?

But first, What is a Rental Property Business?

If you consider a rental property venture, you will purchase one or more properties. Then, following, property owners (yourself, in this case, when you start your business) lease out the units to tenants in exchange for monthly rental fees.

You can have a complete property management system to carry out the associated rent collection and maintenance duties.

So, can I consider my rental property a business?

Of course, yes!

Although some people do not believe that because of the tax filing systems.

Simply put, you own a property that puts extra money in your pocket every month, then you run a side hustle investment.

How to Start A Rental Property Business

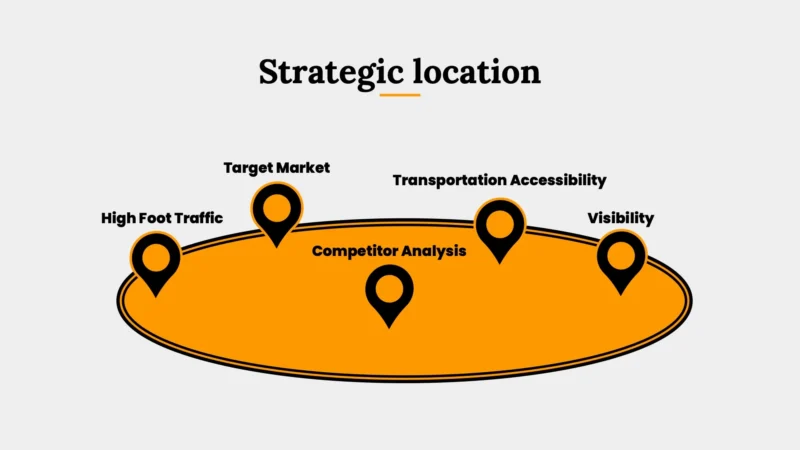

1. Location, Location, Location

This is by far the most crucial and strategic step in running a rental property business.

Choosing the right location for your rental unit decides whether your business will expand and have a future or be a not-so-worth-it investment idea. I know many sad stories of family and friends who purchased properties believing they would be future investments. However, they were not even able to resell them and grow profit.

Here are some points to consider when looking for the perfect unit to buy:

- Neighborhood safety

- Area taxes

- Nearby amenities such as restaurants, supermarkets, shopping malls, coffee shops, and parks

- Accessibility to public transportation

- Nearby educational facilities such as schools, universities, and centers

- A closeby growing job market

All these and much more need to be considered when choosing the location of your rental units.

2. Finance Your Property

Next, you would want to secure the finances you need to purchase and own your rental property.

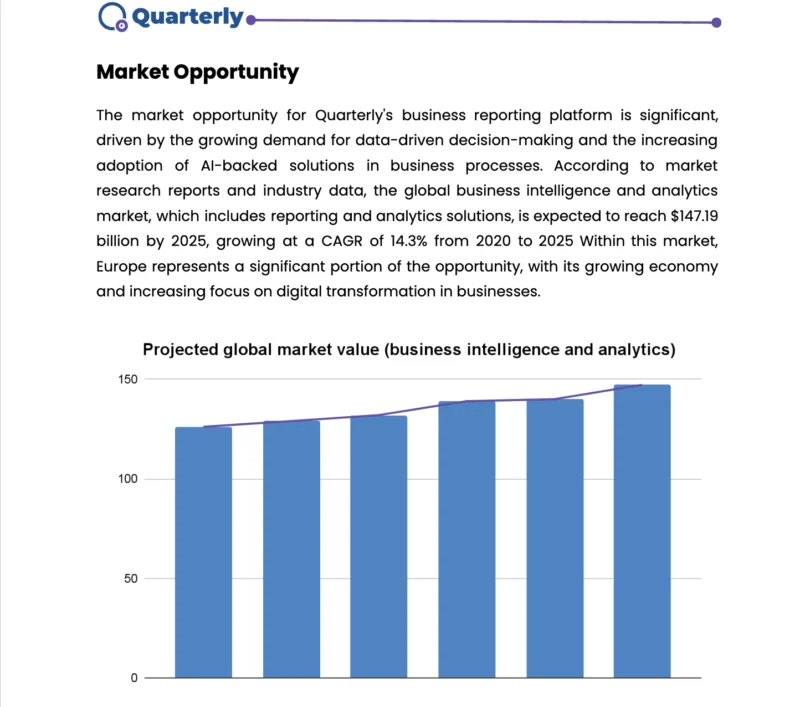

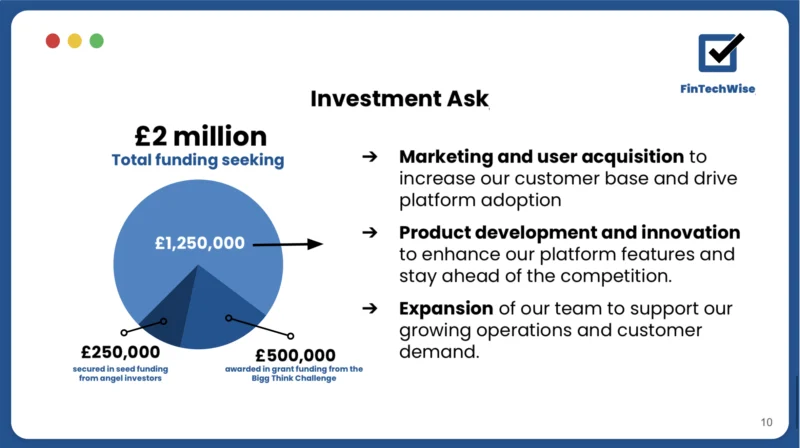

The most common methods used here are bank loans and investor funds. However, you will need a rock-solid pitch deck (which you now can access) and a concrete business plan (our consultants can build for you) to get that!

Other funding resources can include friends and family, your own savings, or financial assistance programs that help entrepreneurs kick-start their businesses.

3. Get Insured

Entrepreneurs often need to pay more attention to this.

However, this is crucial for your business’s success, especially when different people come in and out of your property. You can check the available options for insurance in the market and choose the most suitable and affordable for your business. And, of course, the one that will cost you minimal or nothing as a business owner in case of emergencies.

4. Take Risks Into Account

Like any other business, rental property has its own risks and downturns. You need to take them into account to adjust your plans accordingly.

Among the risks, you can consider the following:

- Maintenance costs or property management expenses can decrease rental income

- Monthly rental income may not cover the total monthly loan payment (if you decide to finance your business through a bank loan)

- Liquidity: rental properties are not liquid assets and take time to sell.

5. Start Making Money

I always encourage you to start advertising your properties in close circles first. This will keep you safe, at least at the beginning of your business. It would be best to have tenants who would leave good feedback on your property while taking good care of it.

Also, start taking good-lighted pictures of your condo to advertise your property on the different rental property platforms. Also, capture photos of experiences that your tenants would want to try out. Images that contain things like a piano, a bicycle, and an outdoor balcony with a scenic view.

If you are unsure about the price ranges for your area, Airbnb.com provides investors with information on the going rental rates for vacation homes or condos and good be a good indicator.

Wrapping up

Now that you have the know-how and the pitch deck template to collect your money, it’s time to start looking for the perfect spot and buy your first rental property.

Start with some leg work, secure funding, get insured, and consider the business risks. Then, start advertising for your rental unit within your close circles. Take perfect pictures for your units, and post them on relevant platforms. Finally, if you are a bit hesitant about the monthly rate you should ask for, look for relevant information.

We have shared some guidelines to help you start your rental property business. However, if you’re out of time and want a consultant to help you plan and complete this, contact one of our freelancers. I highly recommend it.

Meet The Author Of This Article

I’m Jenny Ayman, a project manager in the development field with specific knowledge and experience in capacity building and entrepreneurship programs. I aspire to transfer the hands-on experience I gain in my professional career through writing.

Also, if you need help planning your business, I recommend checking out some of our freelancer’s business plans or pitch decks!