The idea is simple. You‘re interested in a private equity presentation because your raising capital. Your plan is straight forward:

- Convince people to invest their money.

- Gather that altogether.

- Put it in a stock like Apple‘s.

- Earn a 30% annual return for your clients.

- Get a hefty 20% commission of that.

- Buy a jet ski

It sounds like a plan, but you know this also might happen.

- People don‘t trust you enough to invest with you, or you don‘t have a track record.

- The legalities could require a minimum balance that you don‘t have.

- Apple‘s stock might drop massively.

- You might not make enough money to maintain operations.

- A commission of nothing is nothing.

- You can still buy a jet ski, it‘s not that expensive.

If you‘re intending to create a private equity and looking for a presentation designed for capital raising, then you‘ll find one in this article.

But I won‘t leave you stranded with only a template, I‘ll give you my recommendations. After all, I am a ten year business consultant in Switzerland.

Private Equity Presentation (For Capital Raising)

Some of you will only be looking to download the presentation. For those impatient individuals, here‘s the presentation template. You‘ll need to change almost everything to work it out. But this is the most fitting template from my template archives.

Alright, for you wise patient future PE (Private equity) managers. Let‘s create the perfect presentation structure.

PE Deck Outline

Track Record (That‘s what a private equity firm is all about.)

Step 0 is establishing trust. You‘re asking people for their money. Usually, people get very protective when it comes to their cashflow. So, the first step is to establish yourself as a person who don‘t need the money. (What?!)

Yes, you need to establish that you‘re providing them with an opportunity rather than the reverse. Imagine if Warren Buffet speaks to you and tells you that he‘ll invest your savings. It would be a crazy opportunity. You should be jumping from excitement.

He‘s a legend. You‘re not. Additionally, the people who you‘ll approach are probably not going to be approached by Buffet.

So the first slide I‘d recommend you put is a proof of trust, or a track record. It doesn‘t have to be showing that you earned 25% annually for the past ten years (Although, that wouldn‘t hurt.)

Show whatever you could that would establish the answer to the question, “Why would I trust this person with my money?“

If you can‘t ace this slide, or if you start by introducing what your PE stands for, you‘ve lost them.

Team (It‘s a presentation for a private equity, remember?)

Now that you established the reason of them joining you. It only makes sense to introduce yourself and your team. Any investor needs another human face to communicate with when it comes to money. My parents still go to the bank to speak to their banker because they are not comfortable with online banking.

You need to have an online presence to showcase that you‘re confident in what you‘re doing. Anything that lures people away from the idea that you might lose their money.

Strategy (For capital raising as well)

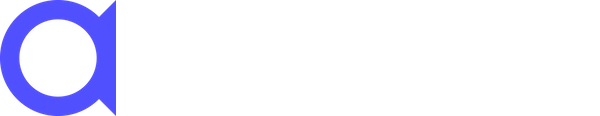

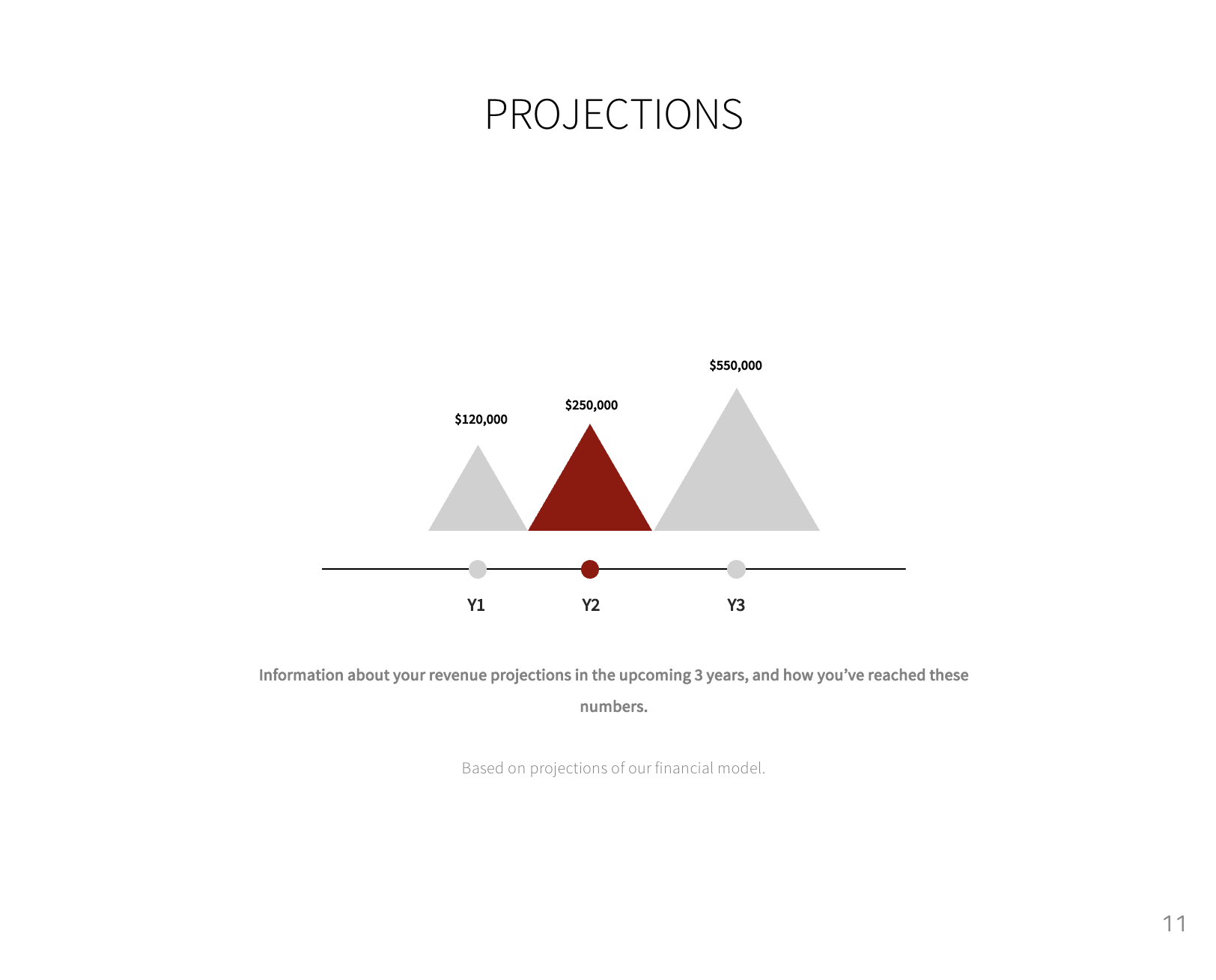

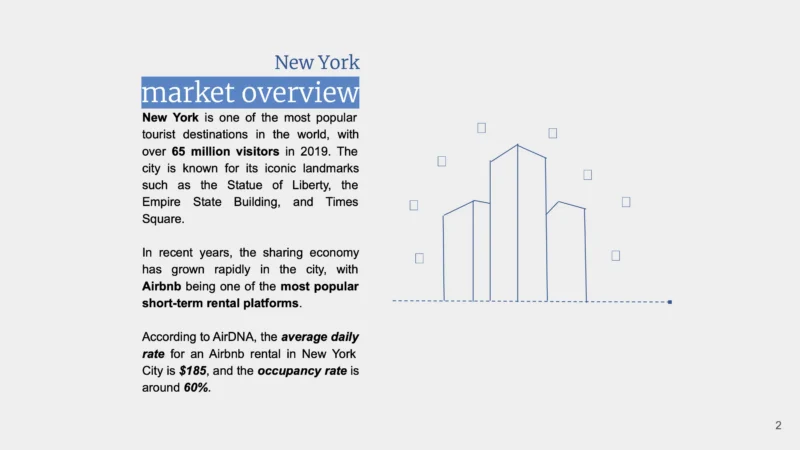

Then you need to talk strategy. You need to showcase how you‘re intending to be better. Remember, they can invest in the Apple stock themselves on Robinhood or some other platform. What would make them invest with you? What‘s your strategy and plan? When should they expect returns? Are they going to receive monthly updates?

Process and CTA (Call to action)

Your call to action and process is the last thing you need to talk about. They need to be sold that they want to invest with you. Only when that happens, you need to tell them how they can do that and what to expect.

Be as detailed as possible. Remember, at this stage, they already want to invest with you. You only need to show them how and to answer common questions.

Try, as much as you could, to not do any further sales tactics here. Do not oversell. It‘ll show up that you‘re desperate and would be a turn off.

Capital Raising in Private Equity is just the start.

Once you‘ve started to raise capital, there are tons of other variables in place. Hopefully, you‘d already have your strategy and advisors in place. Only then, would you be able to truly start with confidence.

It‘s a business like any other, even though it‘s connected to other people‘s funds. You need to inform your investors quite well of what they‘re getting into. You could be a conservative PE, and in that case, you need to operate accordingly.

Meet The Author Of This Article

I’m Al Anany, an entrepreneurship enthusiast.

I love reading about how VCs are earning a 125X return on a specific investment, while others are going bankrupt.

Also, here‘s the pitch deck of Tesla analysed, they raised over $20 billion. You‘ll like this.