WeWork had quite a popcorn-level dramatic run. Their CEO, Adam Neumann, got caught in Israel with a cereal box of marijuana, then was demanded to step down from WeWork. He withdrew $700m from the company before vanishing. Then they created this WeWork pitch deck. Two years later, they went public.

They’ve had a dramatic stock decline ever since then. But so did a lot of companies at that time. Yet, overall, WeWork raised over $22.2 billion.

The story above is a simplification of the drama. However, we’re not here to speak entertainment. We’re here to analyze their pitch deck. Hence, if you’re interested in the full story, head to Wikipedia.

That being said, here’s the latest WeWork pitch deck.

WeWork Pitch Deck

If you’re interested in downloading the PDF, as per all other deck analyses we have, here’s the link.

Then you can review the analysis below. For starters, it’s a 42 paged deck aimed at raising a good amount of funds. It’s after their Series D in a debt financing round. According to CrunchBase, they raised $5 billion on October 30, 2019. After that, they raised $1.8 billion from Goldman Sachs on December 17, 2019.

Since the deck was created on October 11, 2019, it’s likely that it was pitched during these rounds of investments.

Intro Slides (1 & 2)

They start off with a clean and smooth cover slide with the disclaimer of this deck. It’s quite common to do that at the start, like many other pitch decks.

Traction Summary (3 & 4)

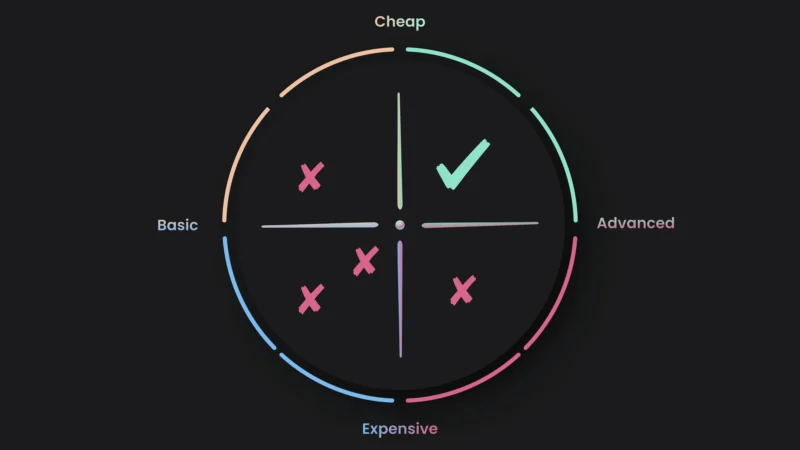

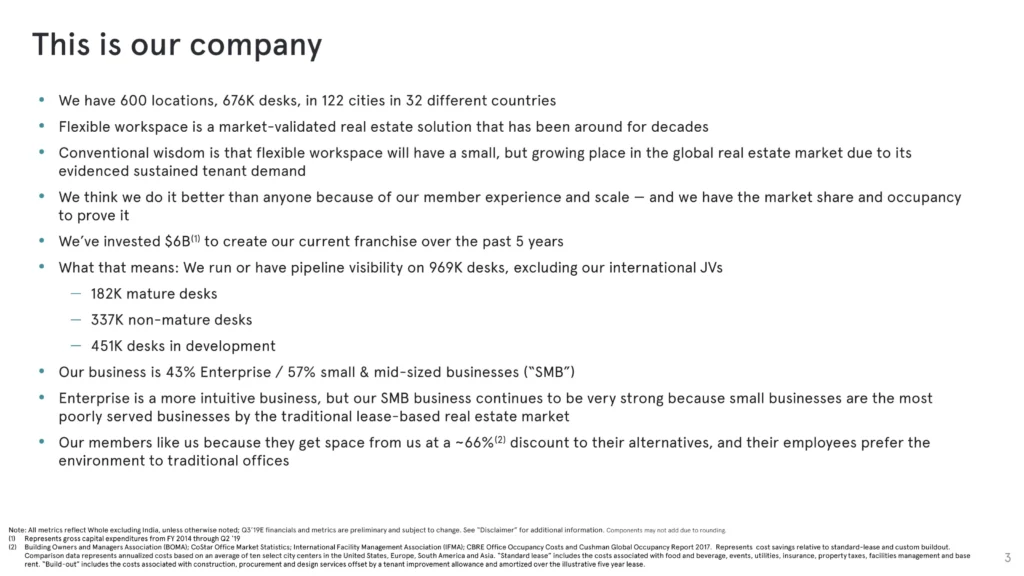

Then they cut to the chase. Think of this as an executive summary. They always say, “Traction is king.”

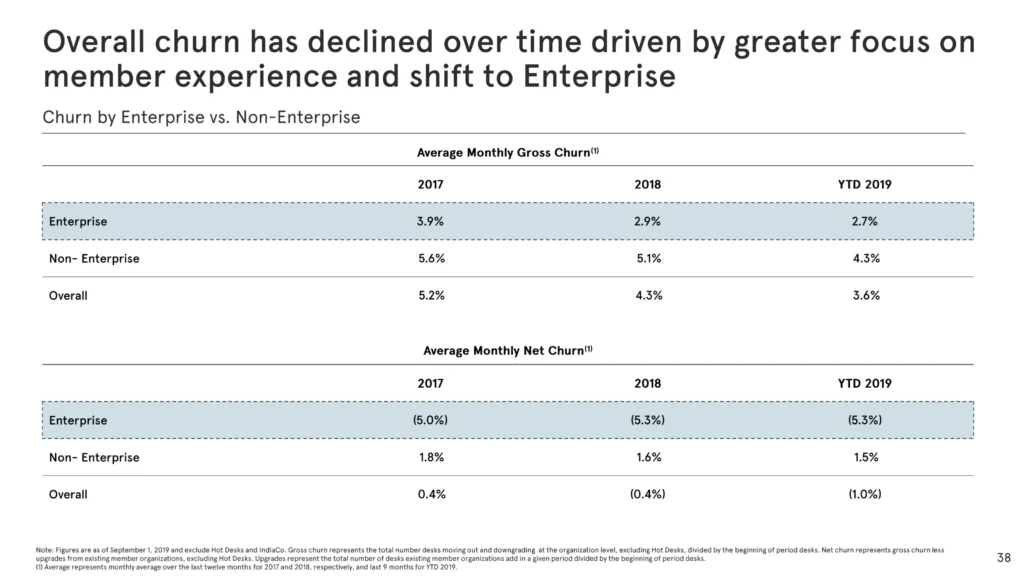

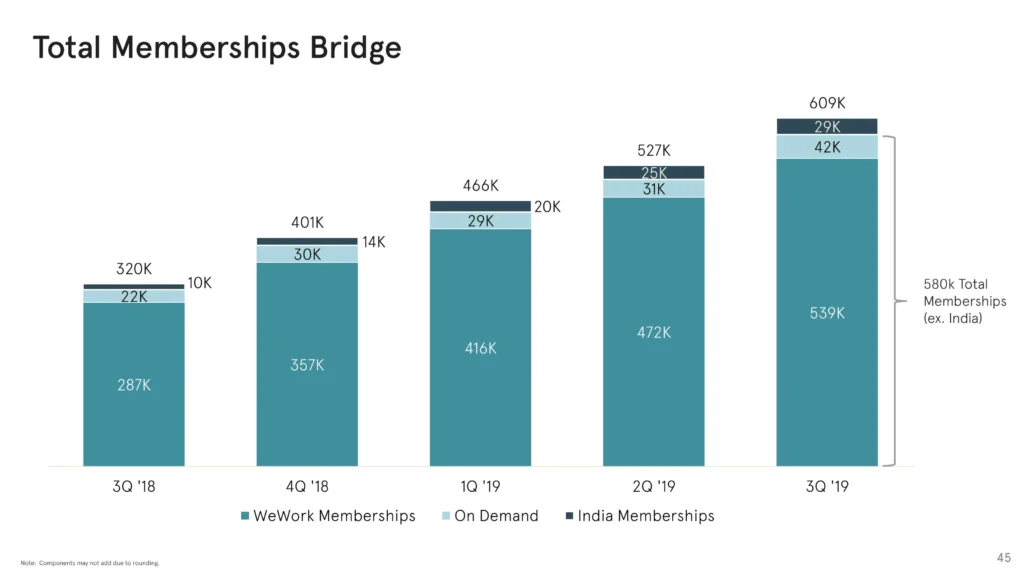

That’s why their initial slides showcase their numbers. (Churn, Locations, Desks, Geographical Expansions, etc.)

The idea is that it’s wise not to keep those investors wondering about your numbers. This is not a pre-seed deck where you’re pitching an idea. It’s a debt financing round that Goldman or Softbank are just looking to validate your progress to determine whether their ROI is worth it.

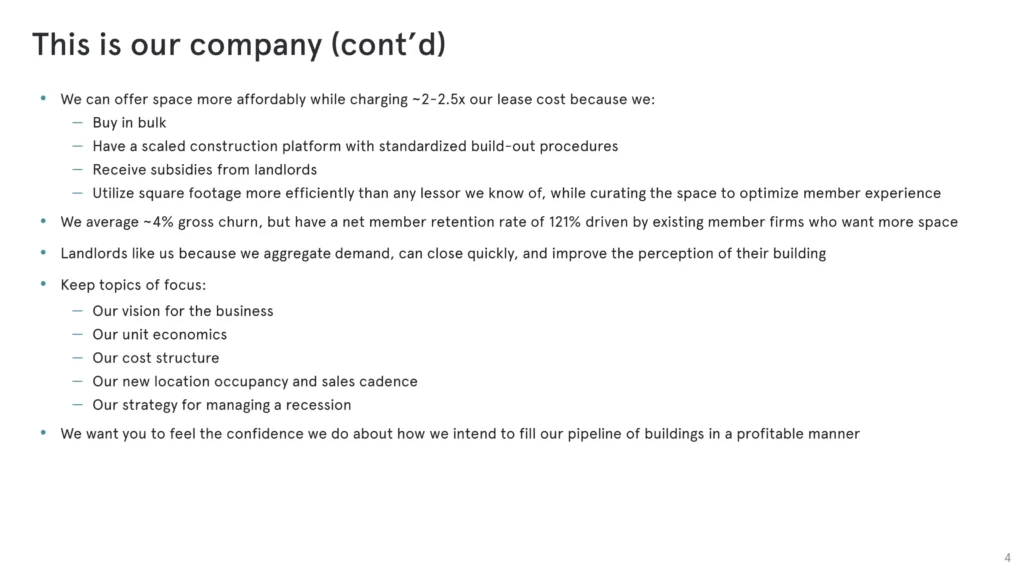

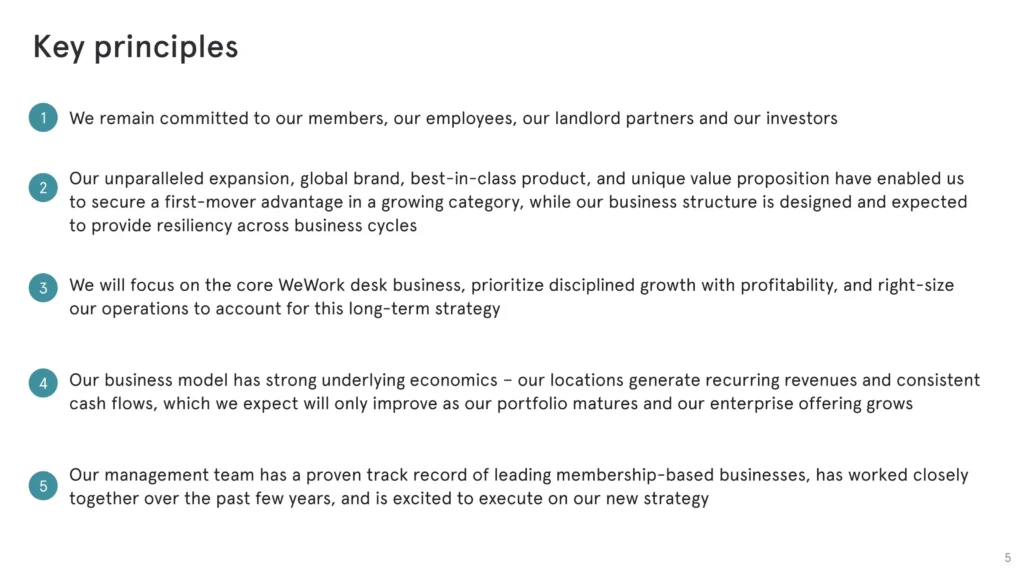

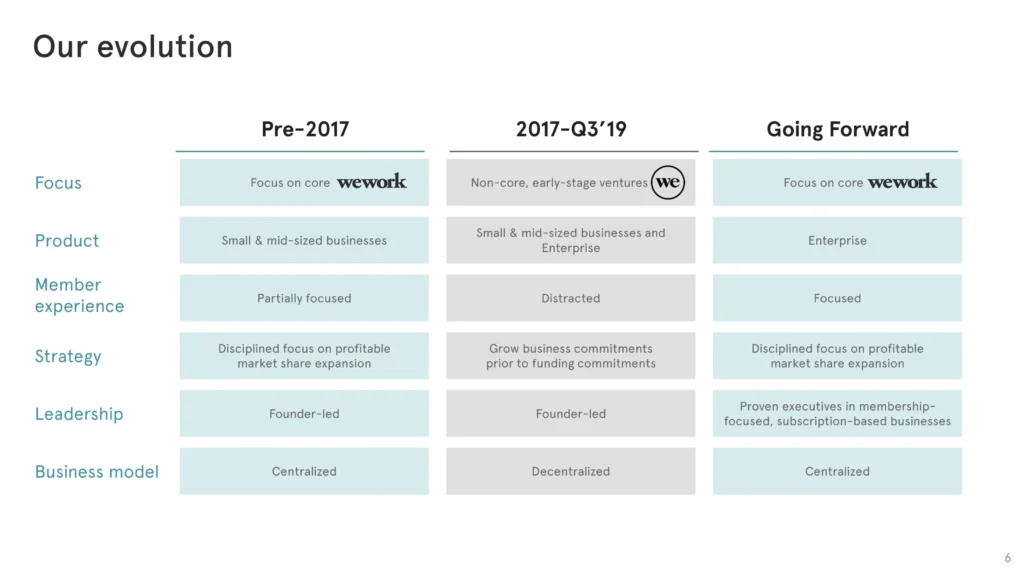

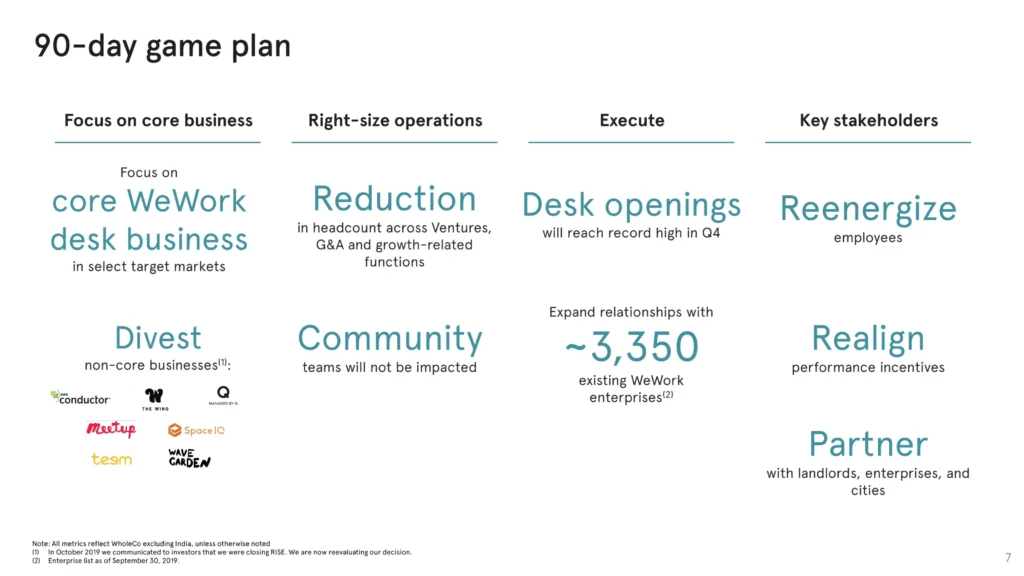

Future Plan (5, 6, 7)

Then they start the discussion. They just recently had a problem with their CEO, Adam Neumann. So they must answer the question, “What’s your plan?”

For that, they pitch their 90-day game plan and their timeline.

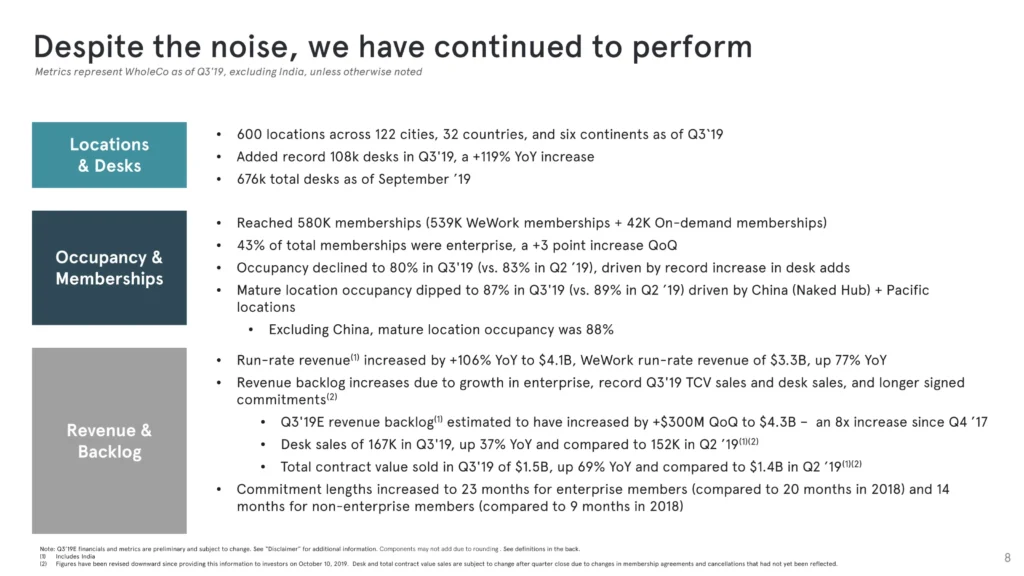

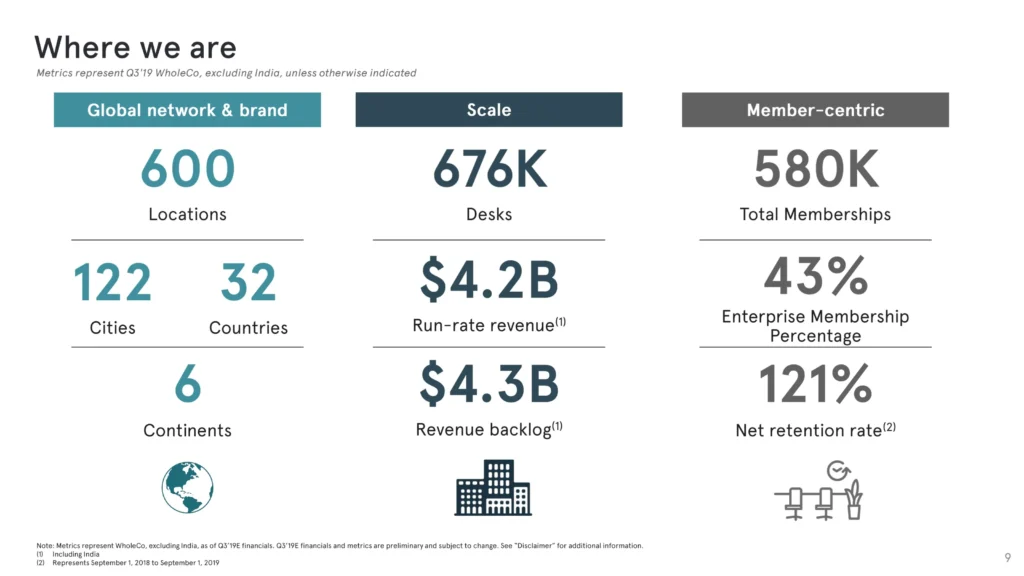

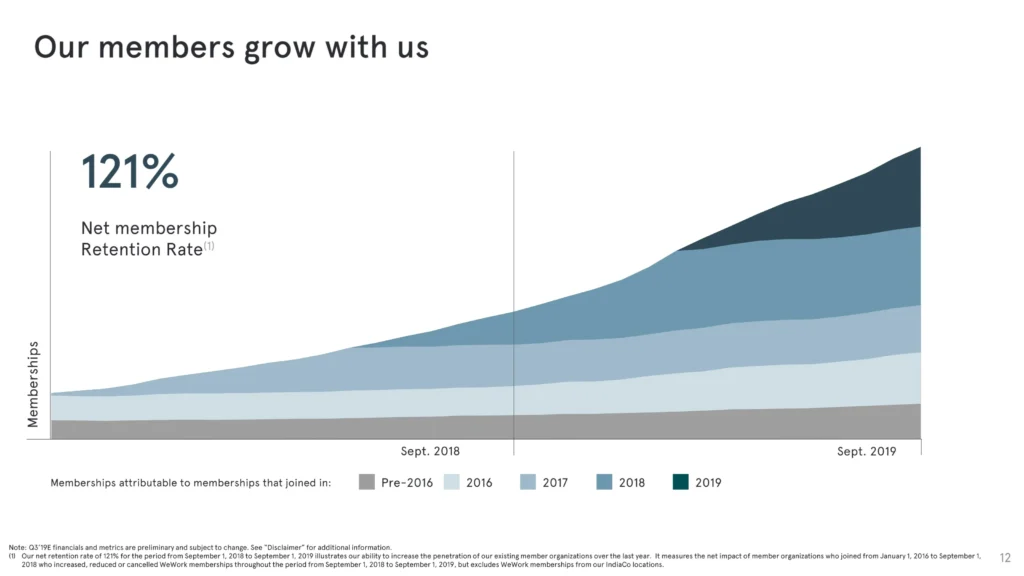

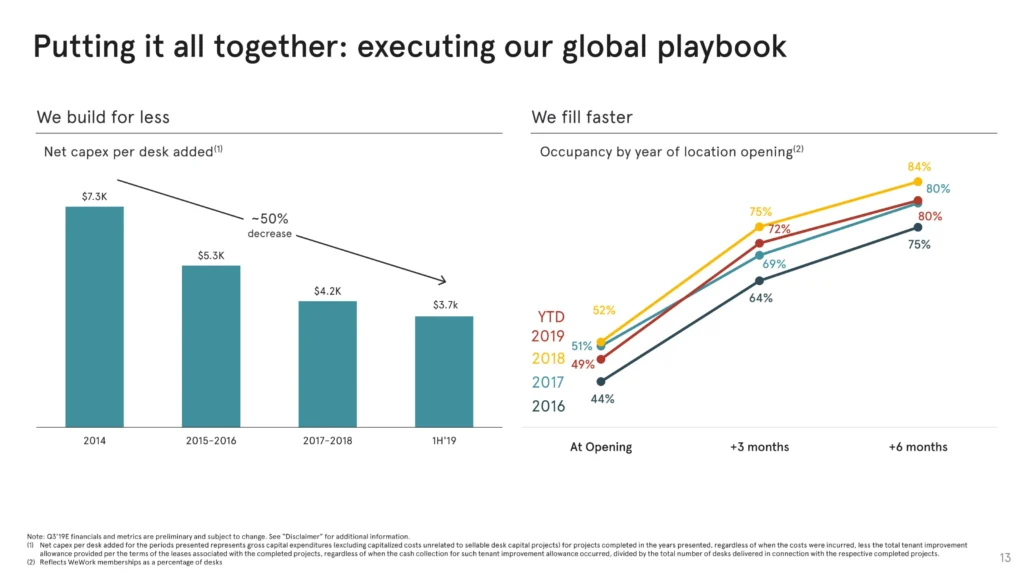

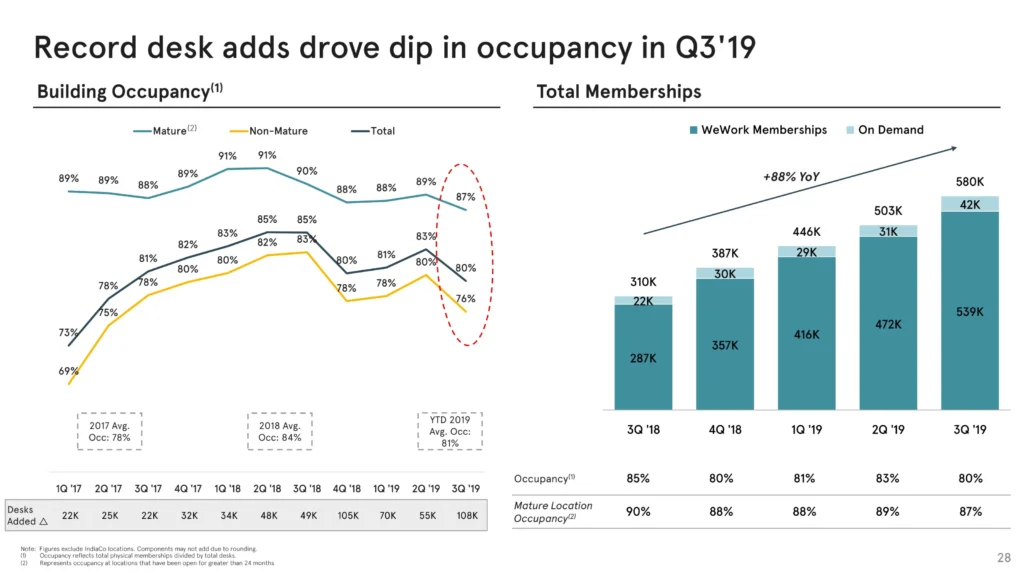

Detailed Traction & Product (8 – 14)

I always love to see traction slides. While companies like FTX showcased they had traction, they were not as detailed as WeWork. Of course, FTX raised $1.8 billion, while WeWork raised $20.2 billion. So it’s not a comparison per see (Oh, and there’s the thing about SBF scamming the world.)

They showcase detailed traction in these slides to answer any question those analysts at the big banks are eager to ask. They want to ensure their client’s money does not go in vain or result in a bad investment. Their jobs might be on the line. So you can’t blame them.

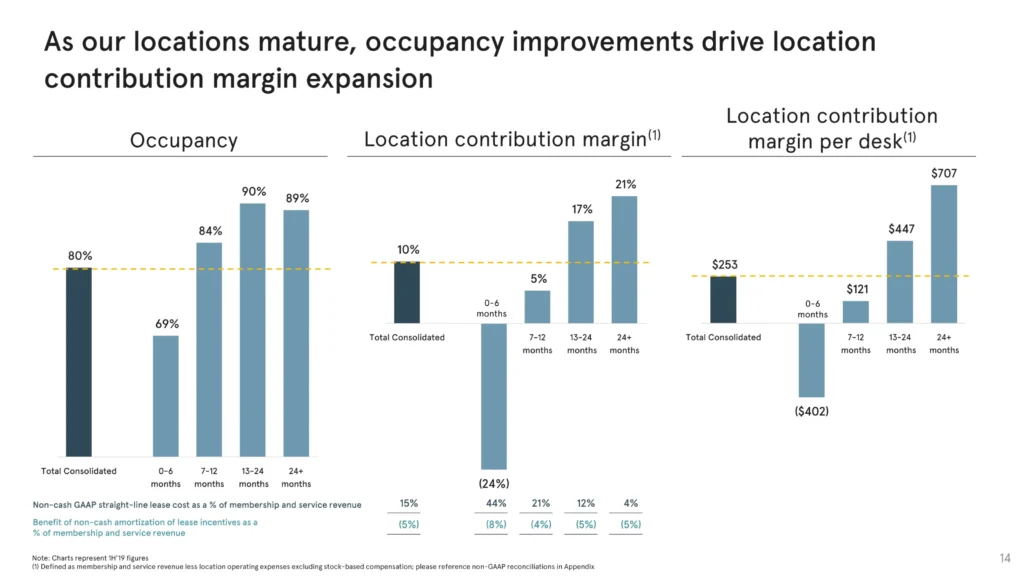

Hence, WeWork addresses those people by answering every question they might have about how WeWork is truly performing in terms of growth and margins.

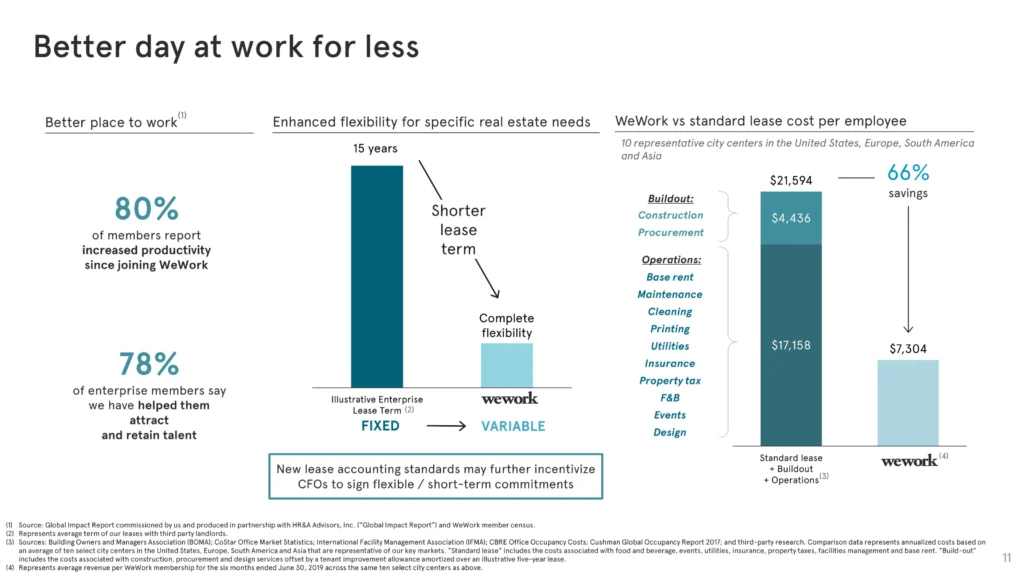

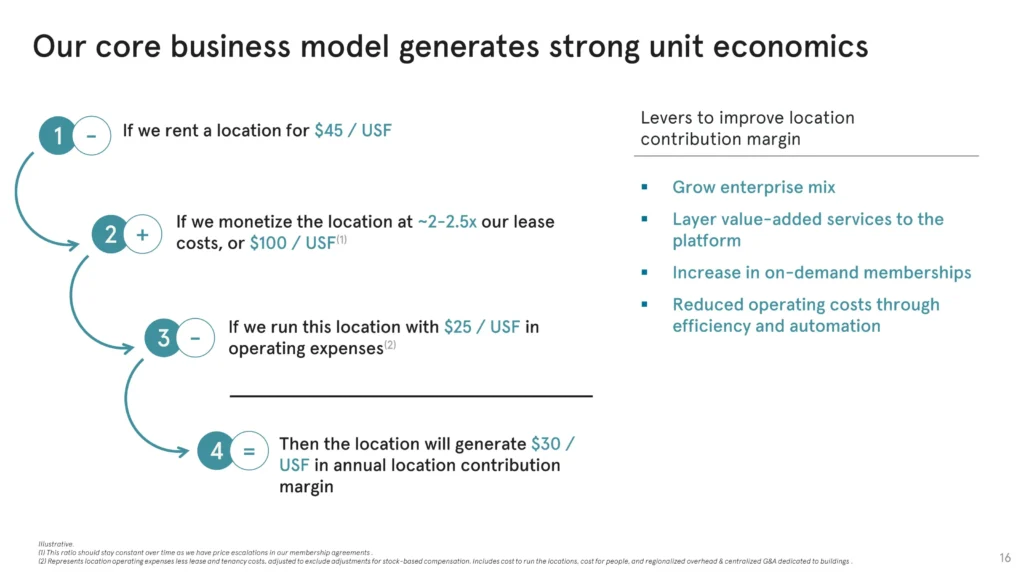

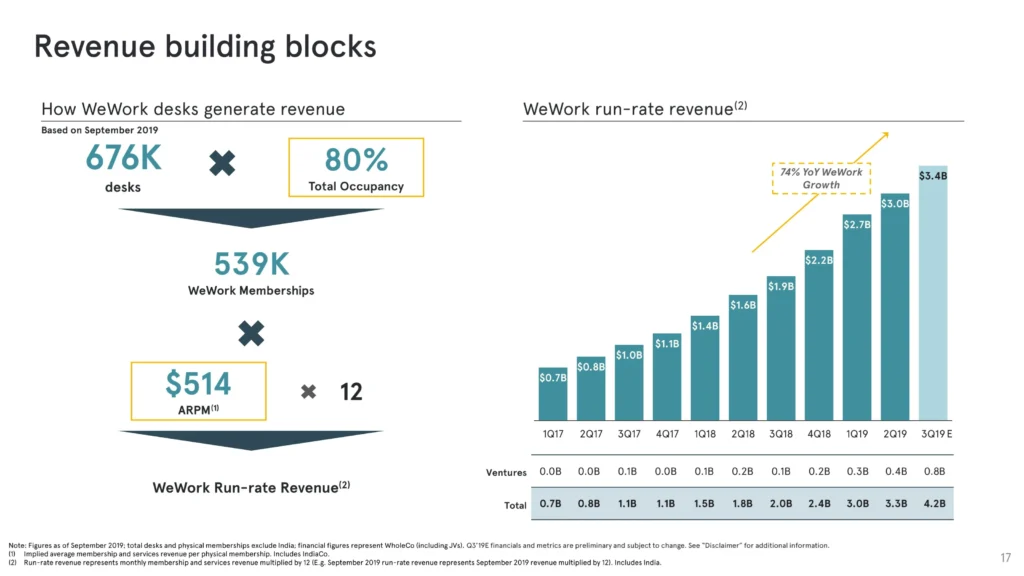

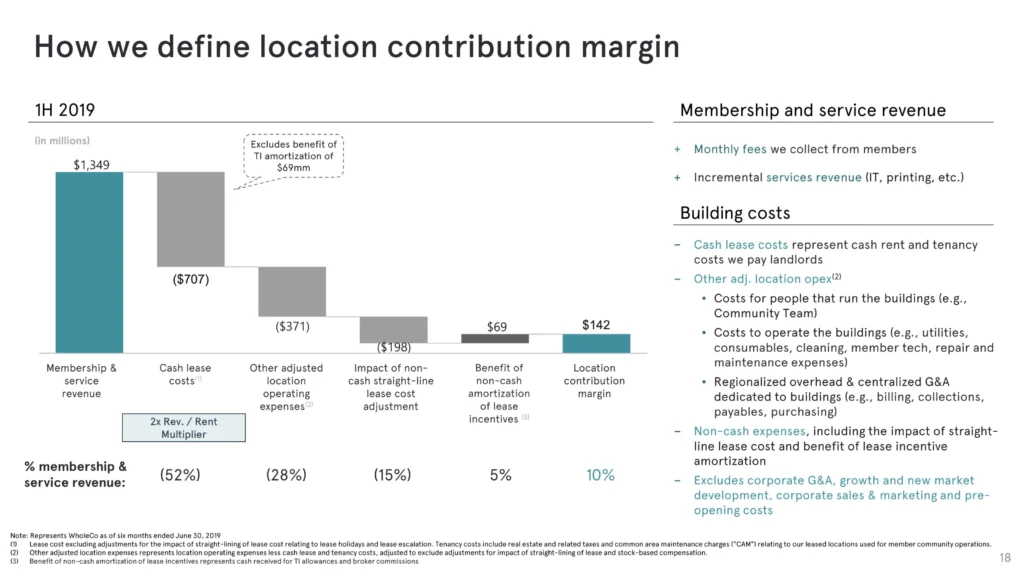

Business Model (15 – 18)

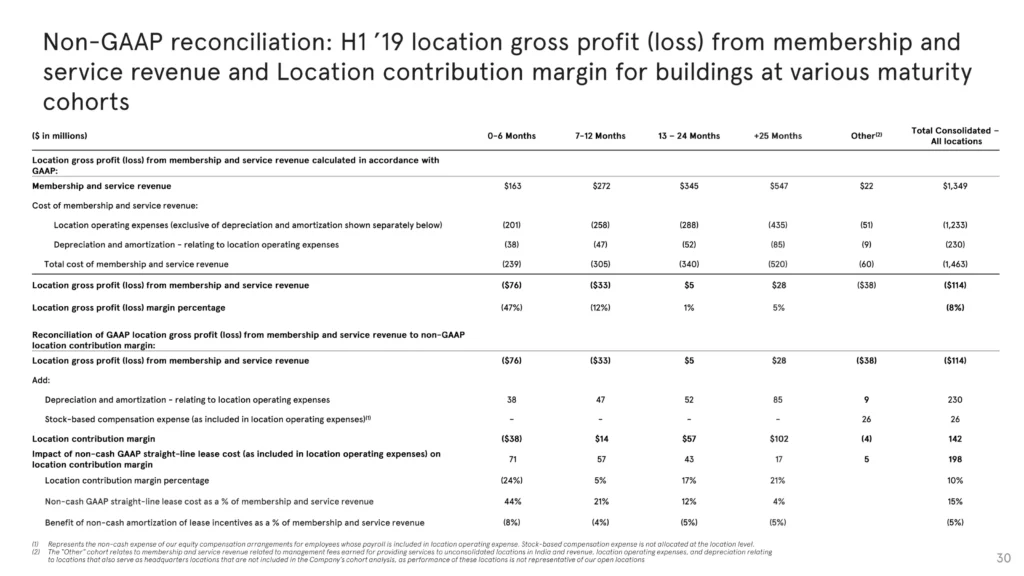

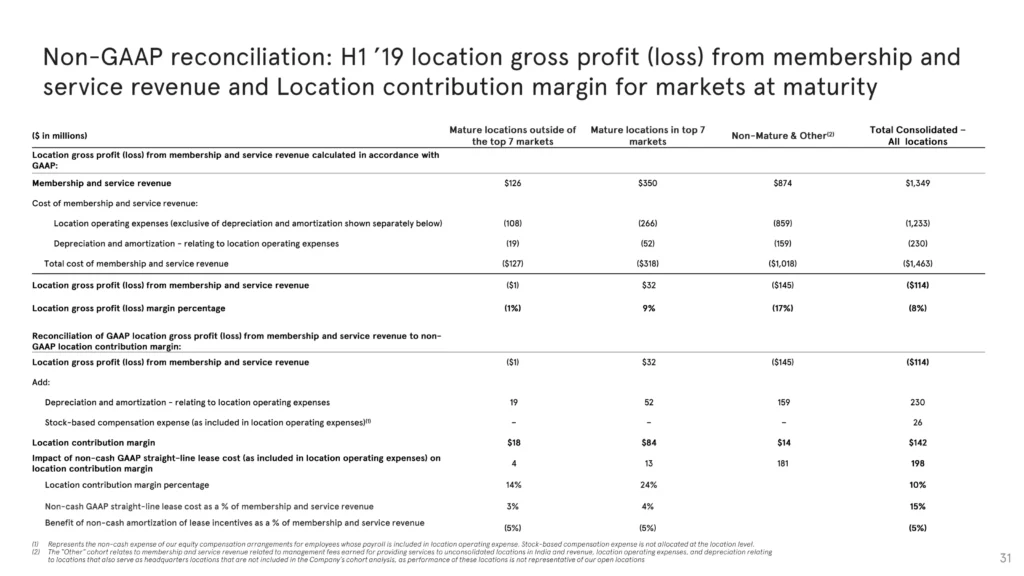

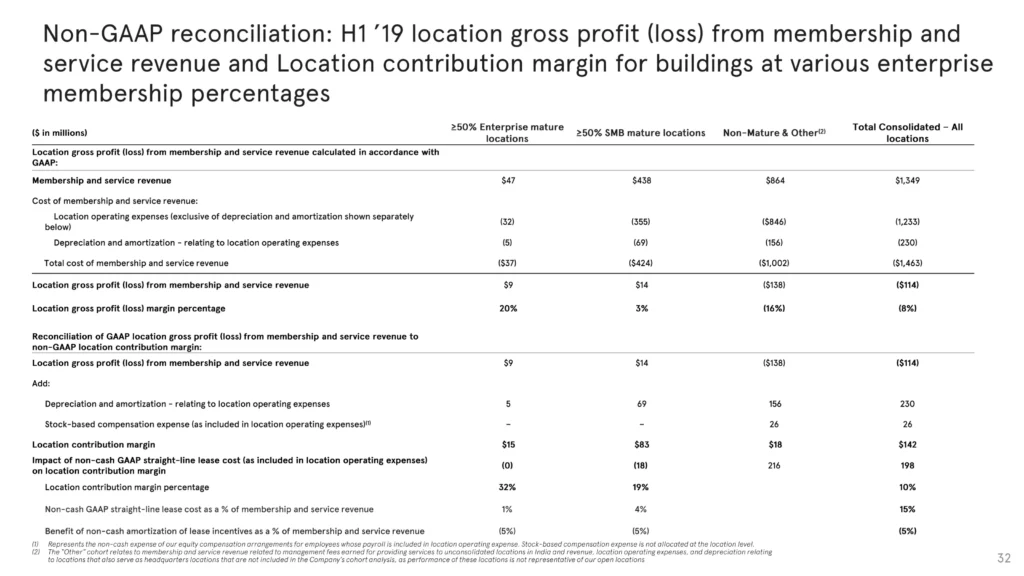

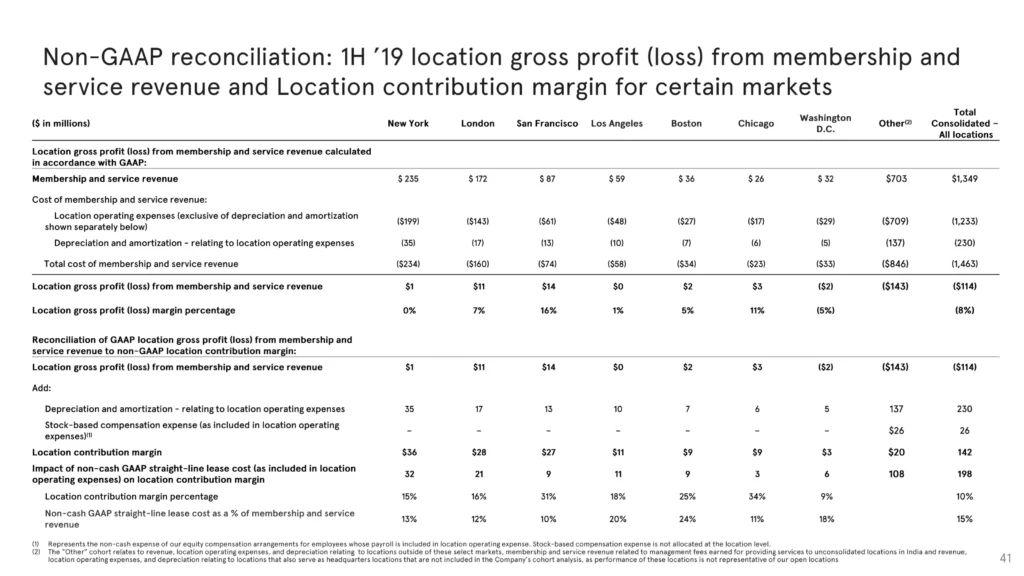

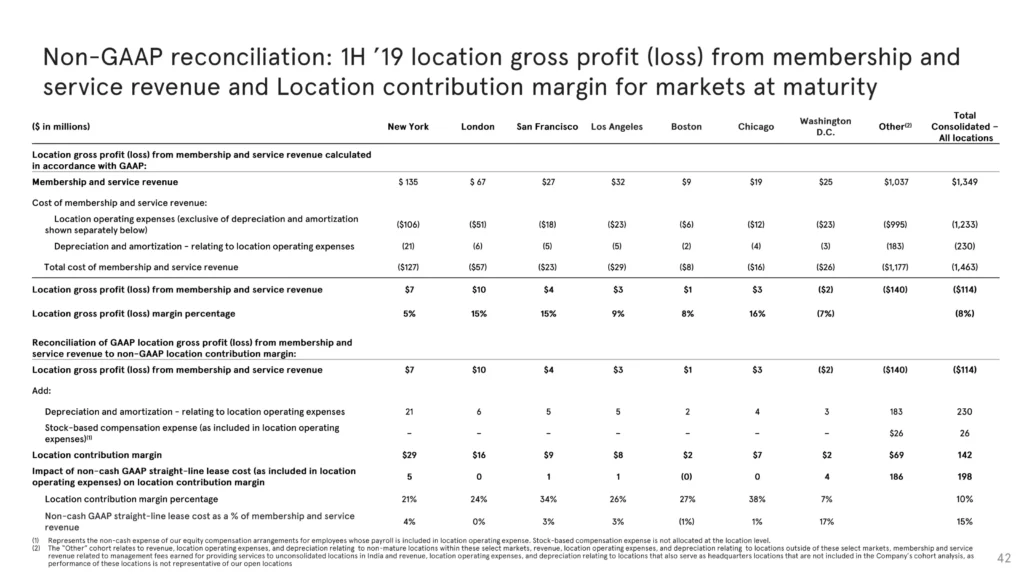

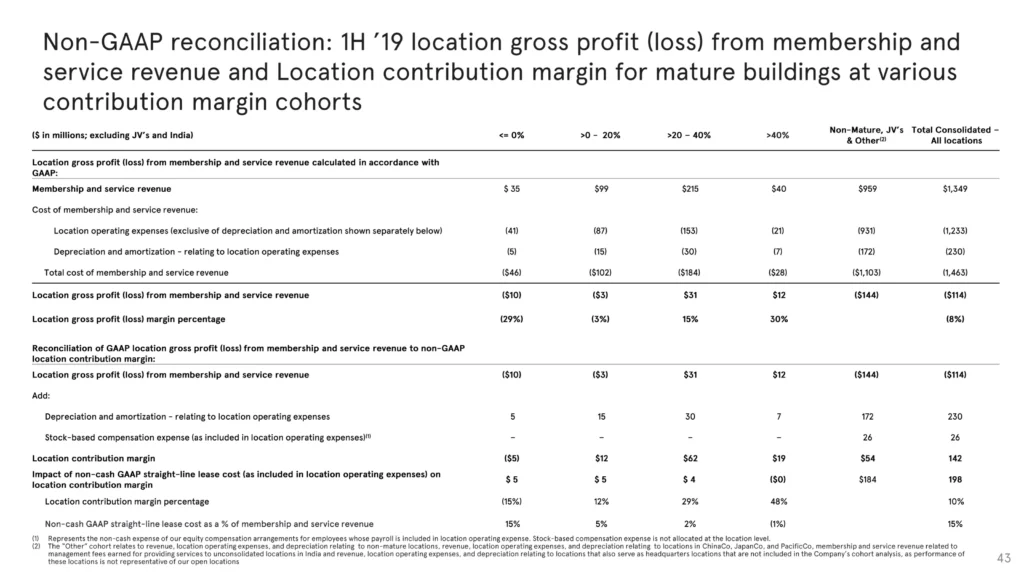

How their profit margins are improving is an essential question. WeWork is not operating with a very scalable model. At least not as scalable as Meta, for example. Hence, they need to detail how the money goes in and their commission accordingly.

This is how they’re having their revenue projections. They are stating them in details so that you wouldn’t wonder where these projections came from.

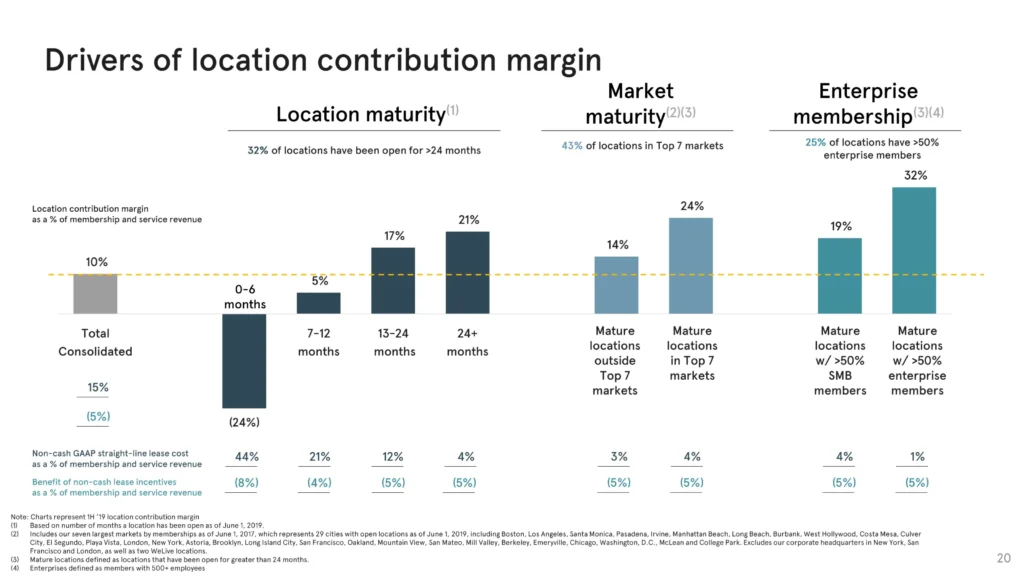

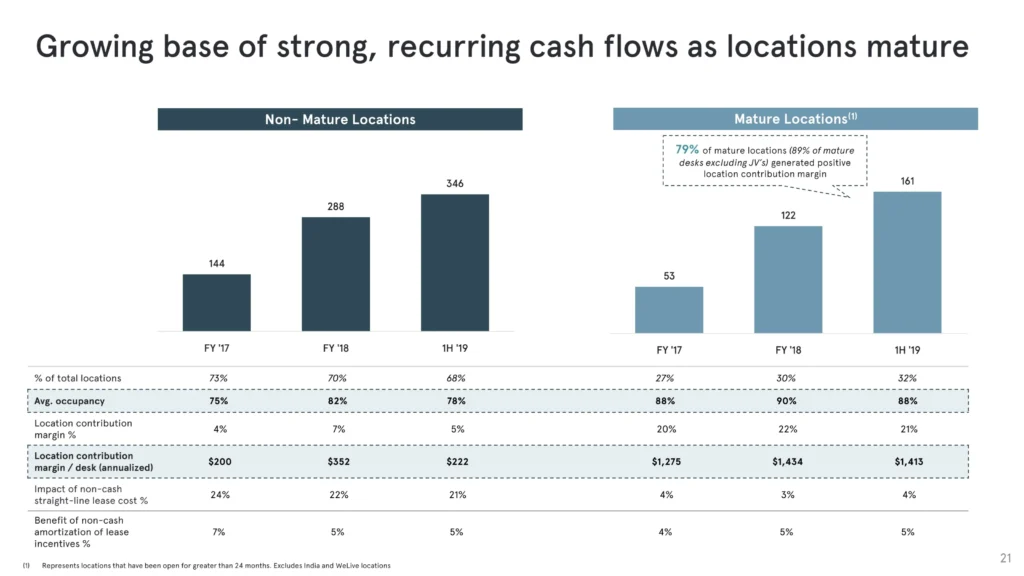

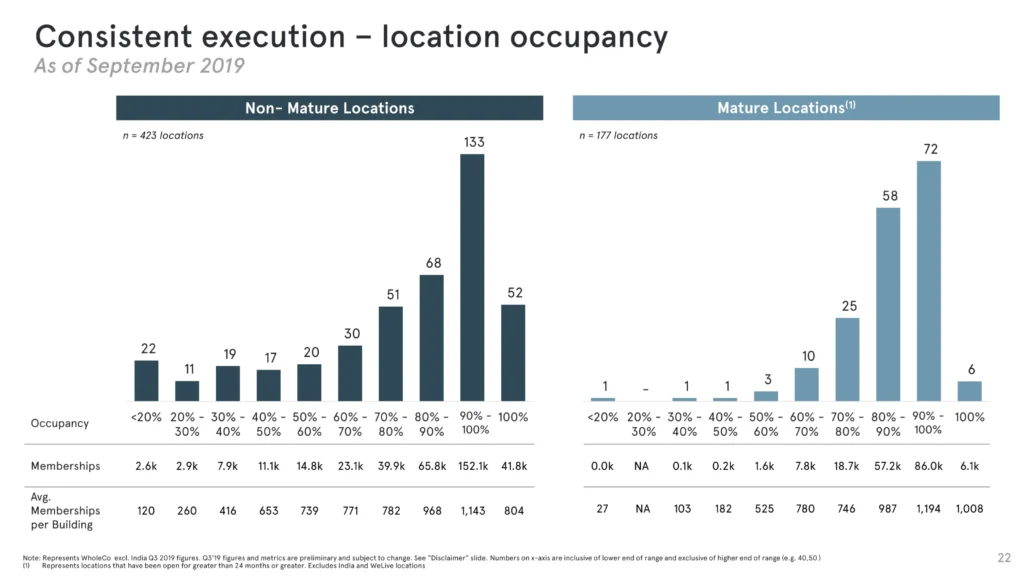

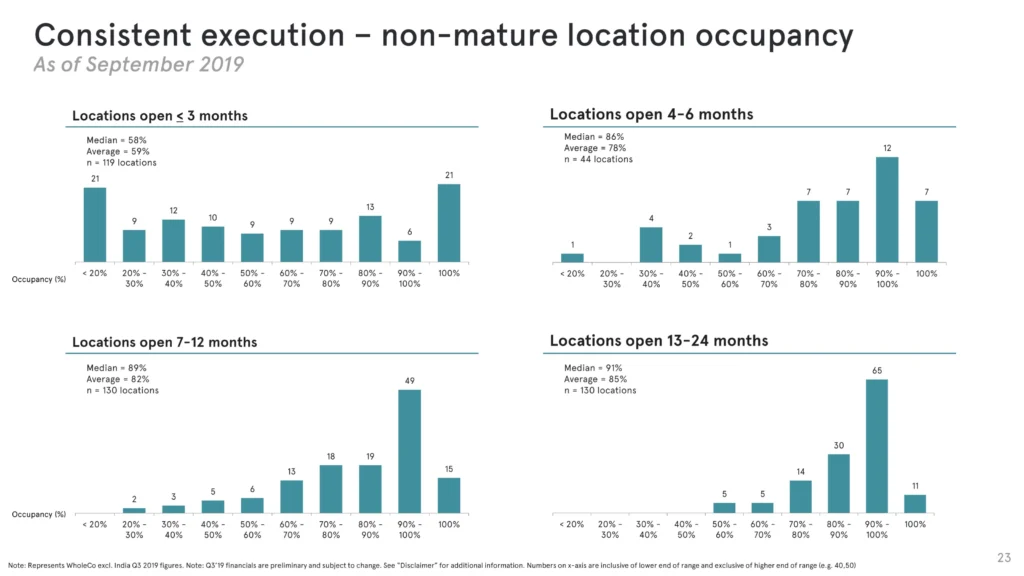

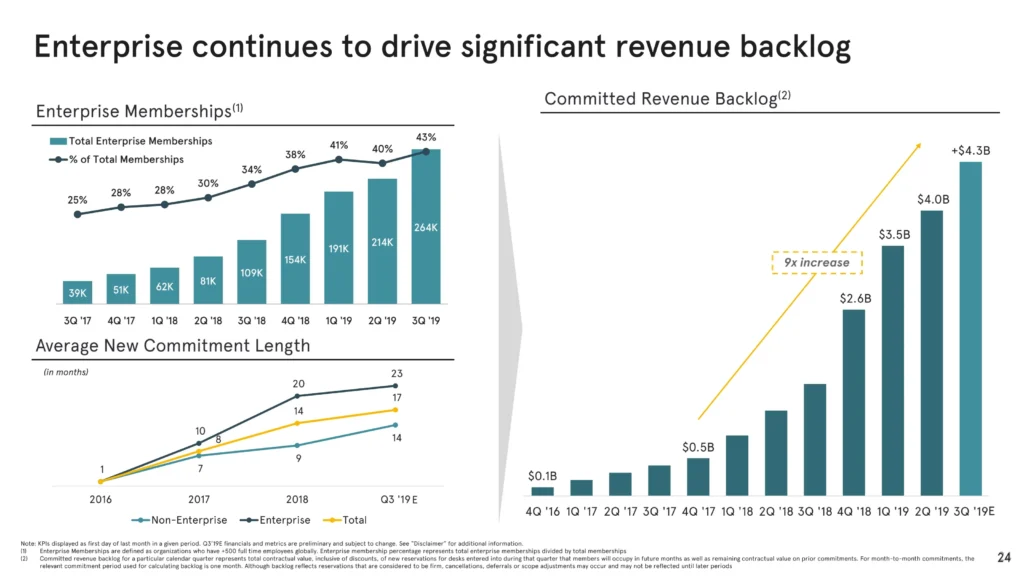

Optimization Plans (19 – 24)

Then they discuss their plan to continue working and growing for the upcoming years by showing their execution plan.

Technically, at that stage, you might consider the deck completed. But investors will have questions, which is why there are extra slides. They’re aiming to answer the questions that might be asked.

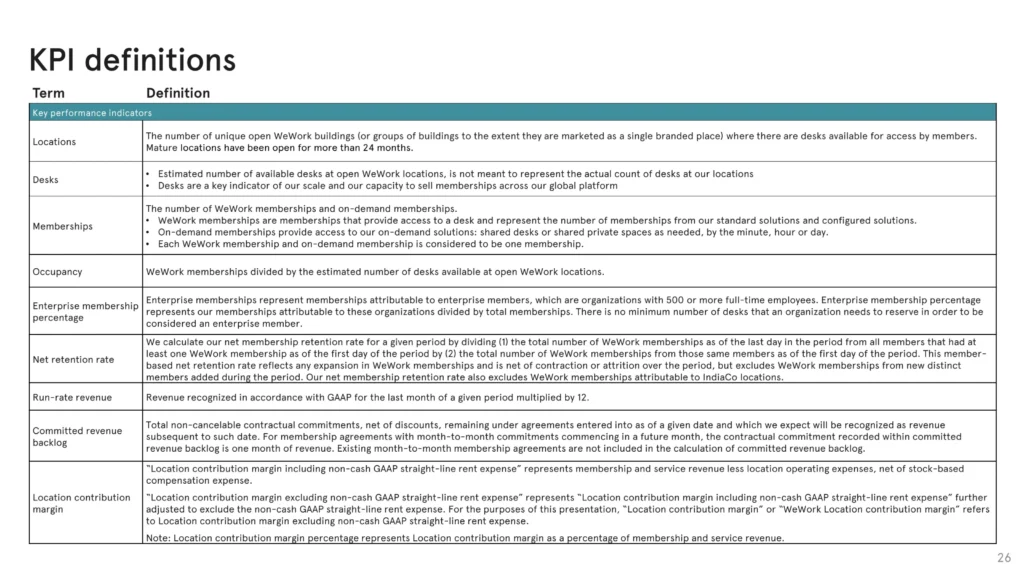

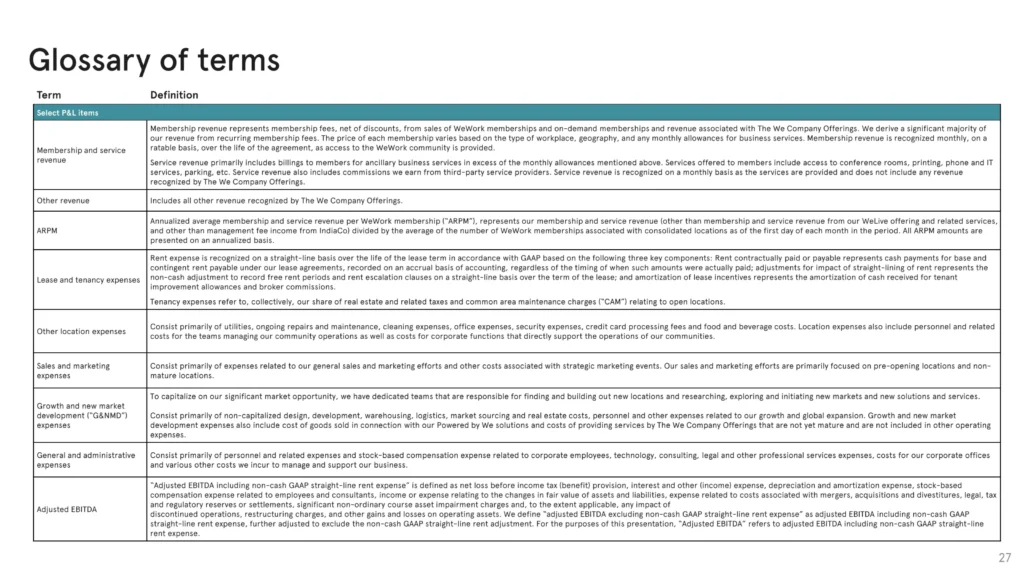

WeWork Deck Extras – Appendix (25 – 32)

Think of this as a more detailed financial table. For those who would not be convinced by the graphs above, this is where they dig into the details of it.

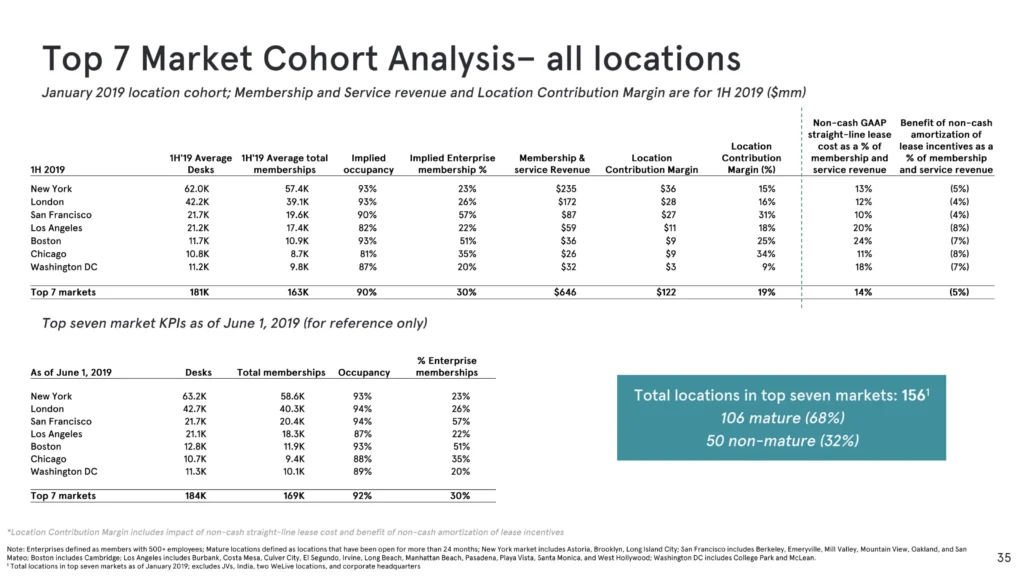

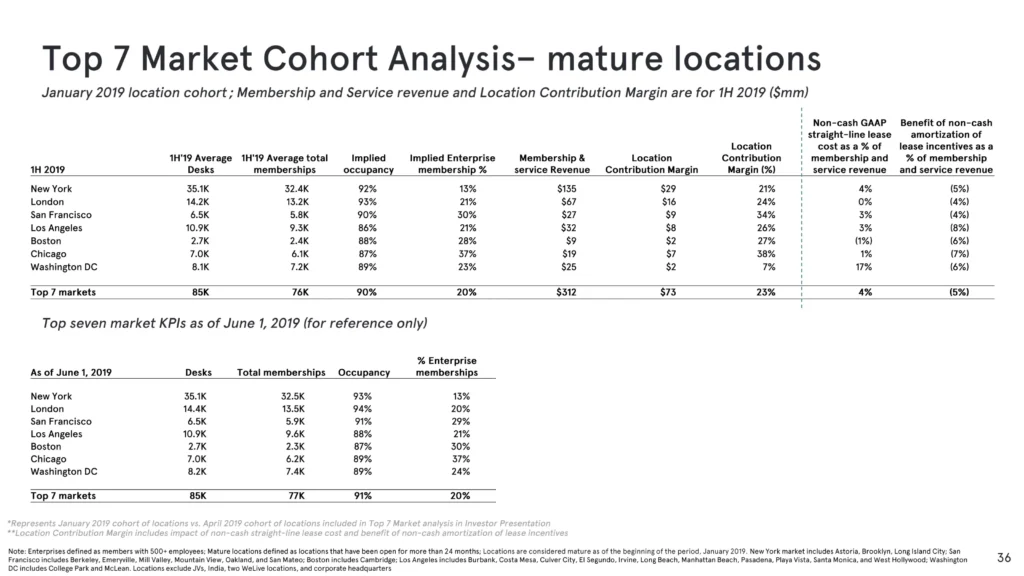

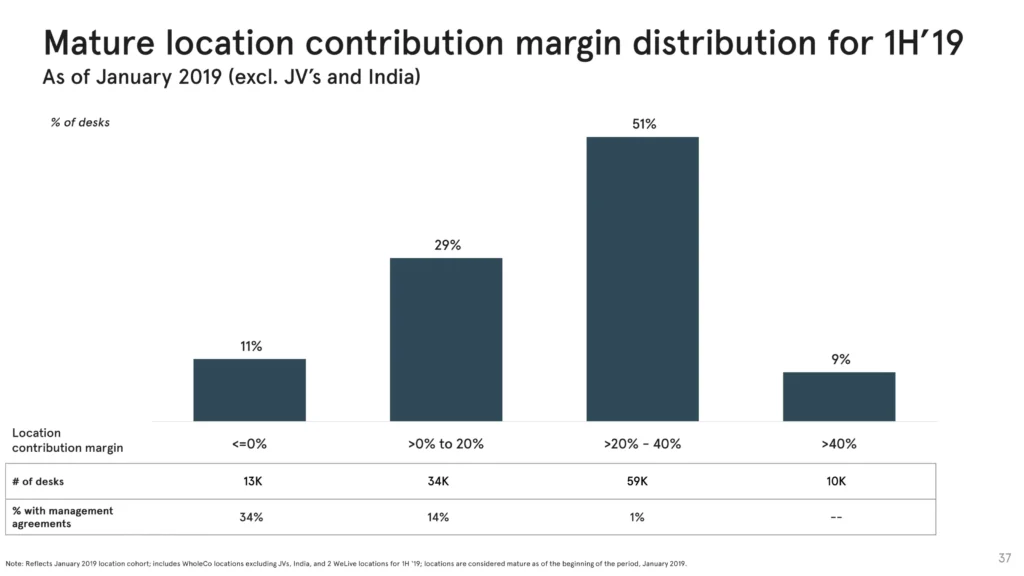

WeWork Deck Extras – Diligence (33 – 39)

Additionally, the geographical aspect is vital. The investors are international, and their business model is as well. Hence, showcasing a geographical analysis of the cities would prove helpful if a question was asked in that area.

WeWork Deck Extras – Further Appendix and KPIs (40 – 49)

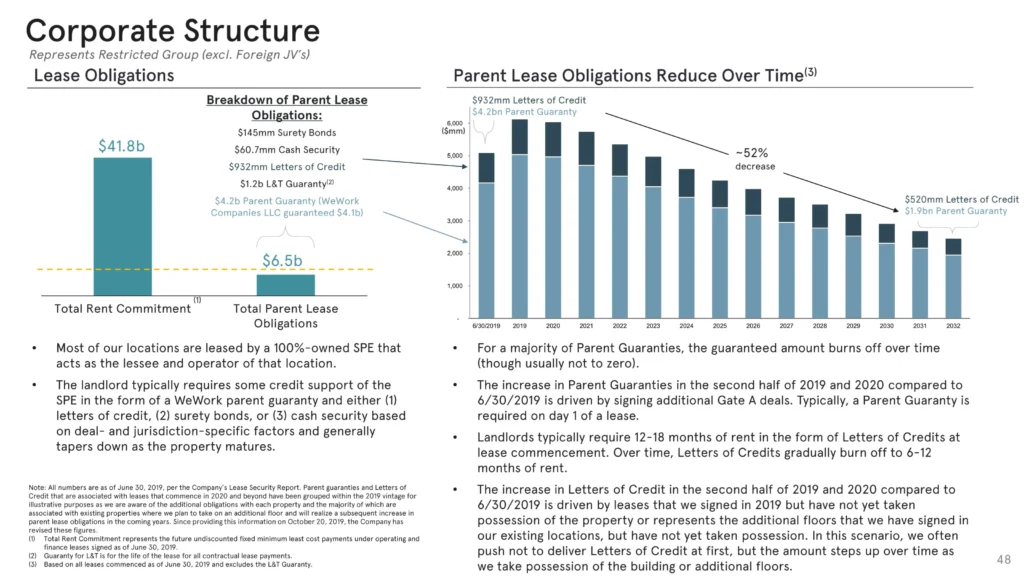

Finally, they wrap everything up by adding a few extra financial tables and information about their team and KPIs. They want to show that their corporate structure is one that’s actually good.

WeWork Pitch Deck Summary

Overall, it’s a wonderful deck that says the following:

- We are quite a successful business.

- We are growing well enough.

- Forget about the ex-CEO’s problems; we have a strong team.

- We intend to go public soon.

I always like statistical decks, which are one of the most numeric ones I’ve analyzed. Let me know what you think of it in the comments below.

WeWork Pitch Deck Looks Like The Tesla One

Oh, and I recommend you explore other deck analyses that you’d enjoy. If we’re thinking of WeWork because it raised $22.2 billion, then Tesla is a good deck to check out, as they raised $20.2 billion as well before going public.

Here it is:

Meet The Author Of This Article

I’m Al; I am extremely fond of entrepreneurship. Situations like what happened with WeWork are my dramatic entertainment.

Hopefully, this pitch deck analysis proved to be helpful!

Have a wonderful day,