Revolut transformed into a giant, competing with Stripe and Wise. They migrated, from nothing to being valued at more than $33 billion. This sort of transformation does not happen without a stunning Revolut pitch deck. So let’s look at it, review it, then analyze it.

The Revolut Pitch Deck in PDF

In many cases, readers want the pitch deck to review themselves rather than have a full analysis. If you’re looking for that, here’s the download button. But if you’re looking for a detailed analysis from me, a ten-year business consultant, then keep scrolling.

Revolut Pitch Deck Analysis

Here at Albusi, if you go through some of our freelancers’ services, you’ll notice that we use Stripe. The truth is, our accounting did inform us that Revolut is providing very competitive options compared to Stripe. We estimate to be migrating there in a year or so.

We are a simple example. Thousands of businesses are flocking to use Revolut. But we need to back up and see how they raised their seed funding. Hence, here’s their deck.

It’s a short deck that’s to the point. We’ll be going through each slide. If you’re looking for inspiration that’s similar to this deck, then I’d advise you to check out the Airbnb pitch deck.

Slide 1 – Cover

They start with quite a mundane cover page, as most decks do. The founder puts his contact information. There’s not a lot to discuss on this slide. Many decks like Airbnb, WeWork, and Uber started with a similar cover. There’s no elevator pitch that could’ve made it pop a little bit more.

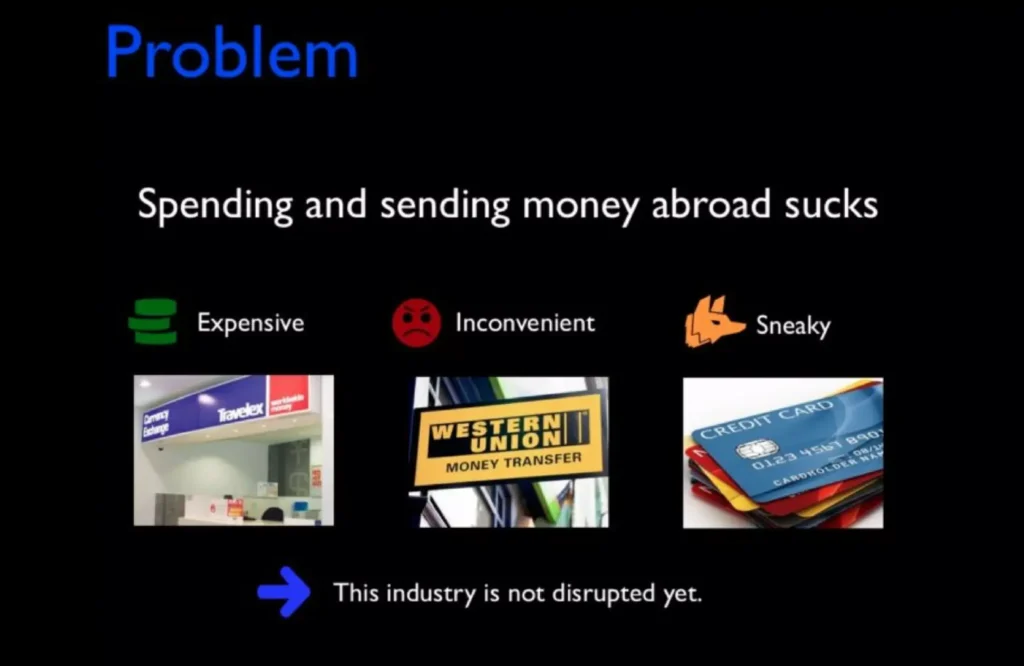

Slide 2 – Problem

The initial Revolut was not intended to be competing with Stripe. Their initial approach was taking on bank transfers and other money transfer options. They wanted to simplify it. At that time, this was quite revolutionary as it was a fight against banking, which was not quite an easy battle.

Personally, I’m based in Switzerland. Banking versus Revolut is not that big of a debate. I’ve transferred funds through both options, and bank transfers here seem to be easy. But also, Switzerland is quite famous when it comes to banking. The focus of Revolut is all other nations that have difficulty in such transfers.

Slide 3 – Market

Then, what only makes sense next is pitching how big the market of transfers is. They do that with the famous slide that shows the TAM, SAM, and SOM. They launched initially in the UK, which was quite a good market to experiment with as it has quite a large number of expats and travelers.

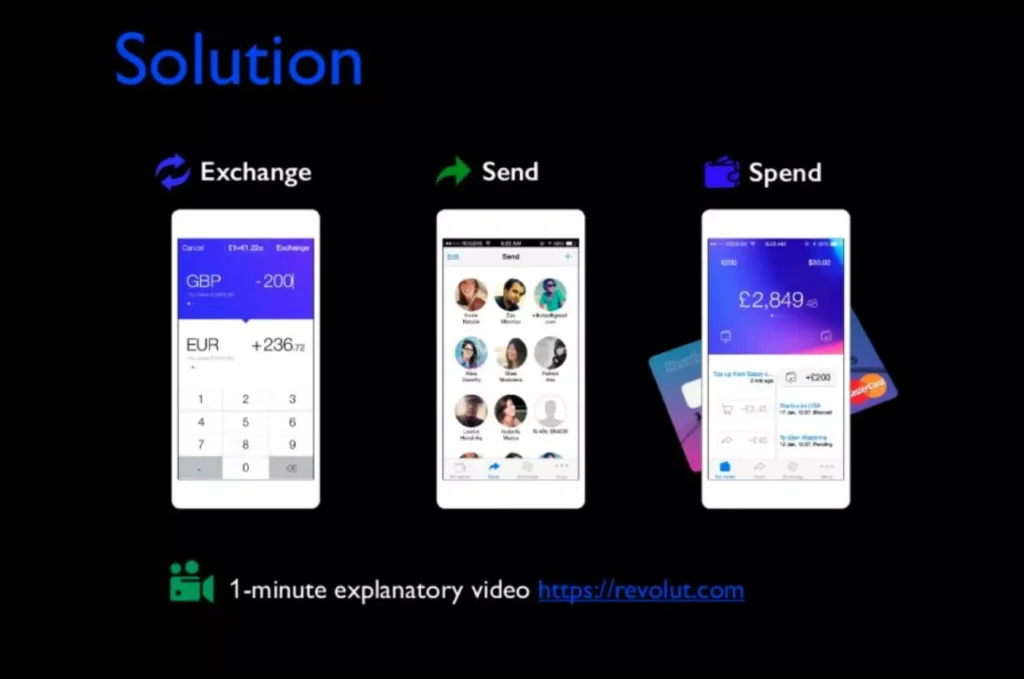

Slide 4 – What is Revolut?

Then they pitch what Revolut is in a very simple slide. What’s not usual is the fact that they included a 1-minute explanatory video. Yet, it’s extremely wise to showcase it that was as many investors wouldn’t be interested in getting into details. So keeping it as an optional choice is a smart move.

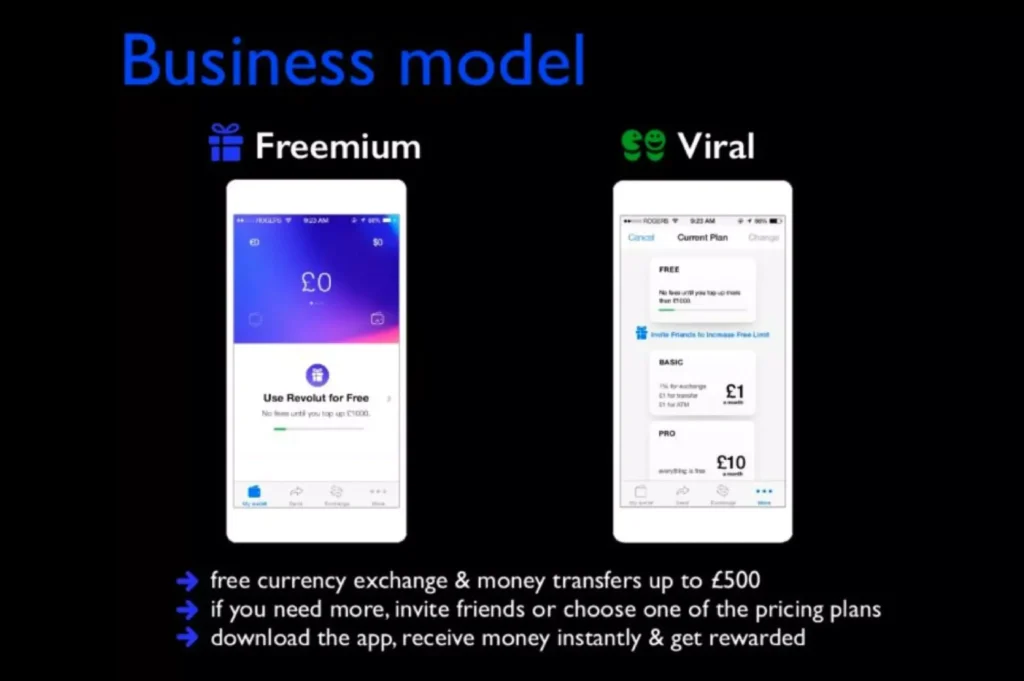

Slide 5 – Revolut Business Model

Pitching their business model was not that complex. Nowadays, if they do the same thing, it would be quite a complex slide.

Slide 6 – Revolut Marketing Pitch & Strategies

It’s crucial to convey how they’ll penetrate a saturated market. They showcase their go-to-market strategy in the simplest form.

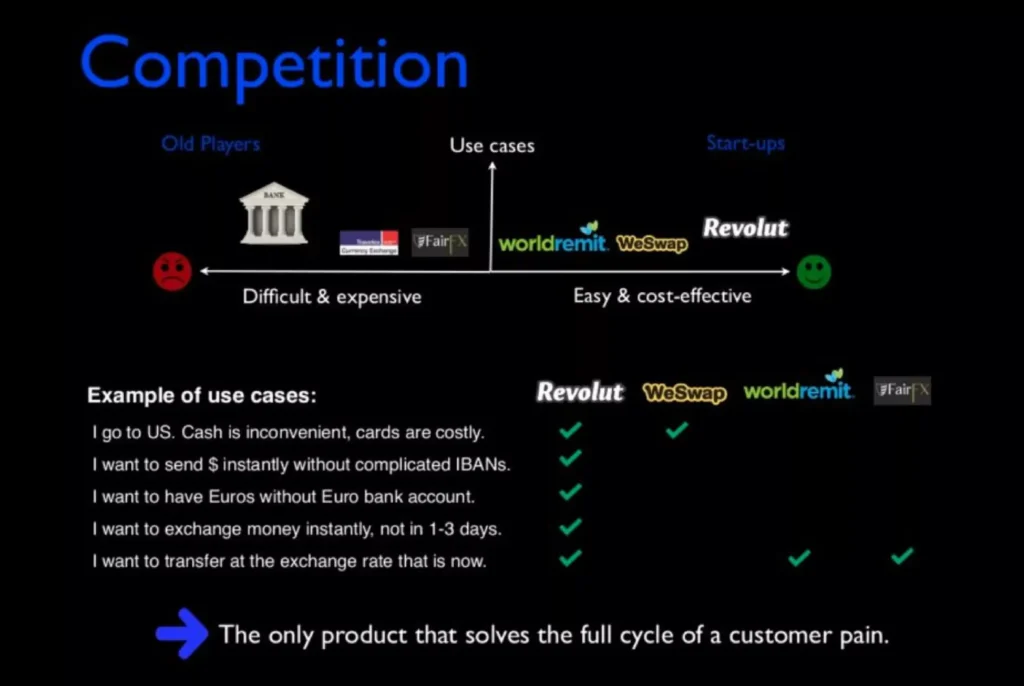

Slide 7 – Competition

As mentioned, they’re trying to position themselves as an easier and cheaper option compared to banks. Hence, showing this in a graph like this is the optimal way to do so.

Slide 8 – Why is Revolut better?

Revolut starts to pitch its unique selling points in the form of icons. All the points mentioned are quite valid. What’s important to notice is that this deck is mainly designed to have a speaker explaining it rather than just being sent to an investor, as this slide, for example, has to have some speaking involved.

Slide 9 – Traction in the pitch deck

To show that they mean business, Revolut had to throw in traction. It wasn’t that impressive then, but for seed funding, it was more than enough.

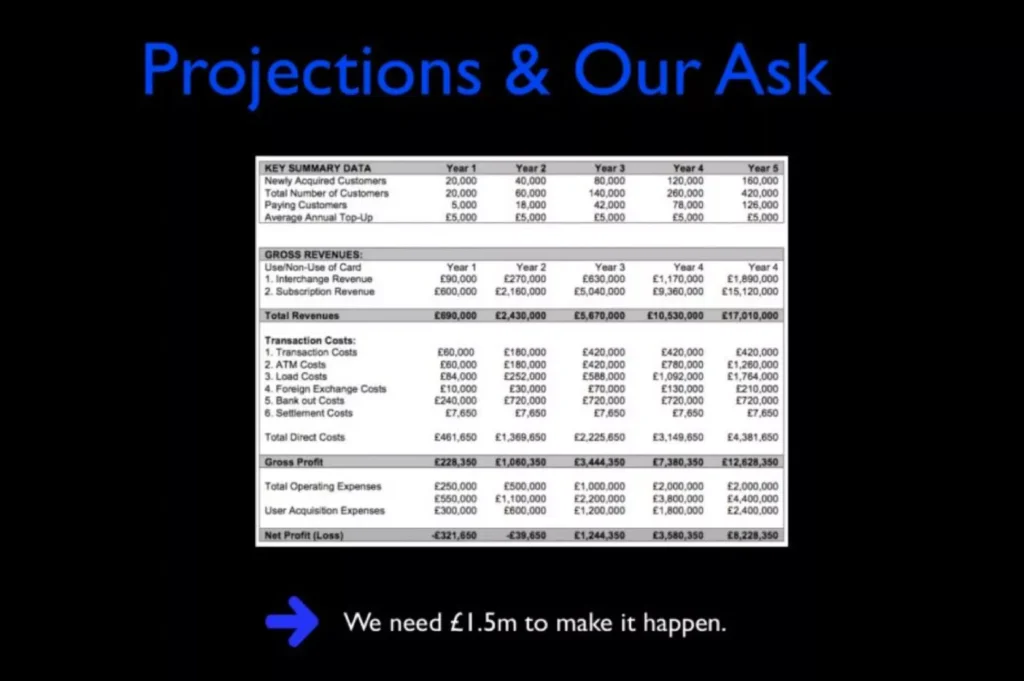

Slide 10 – Revolut Pitch of Projections

Then they start showing their projections. The truth is, this slide was not that necessary because those numbers were quite tricky to believe. They probably had a large variance to their actual figures.

Slide 11 – Revolut Use Of Funds

“What will they use the seed funding for?” is a question usually asked by investors. Hence, they showcase the answer by stating what they generally will use the funds for. They did not get into specifics.

Revolut Pitch Deck Verdict and Conclusion

Overall, the deck is okay. It’s not that impressive compared to the others. It raised over $1.8 million dollars. Then it transformed the company into what it is. So even if the deck was mundane, the market loved the product, which speaks louder than all the investors in the world.

What I think is worth learning from this deck is how they studied the market and knew it quite well. This goes beyond the pitch deck, obviously. However, it reflects on the deck, which shows the investors that as well. Hence, this provided them with a win.

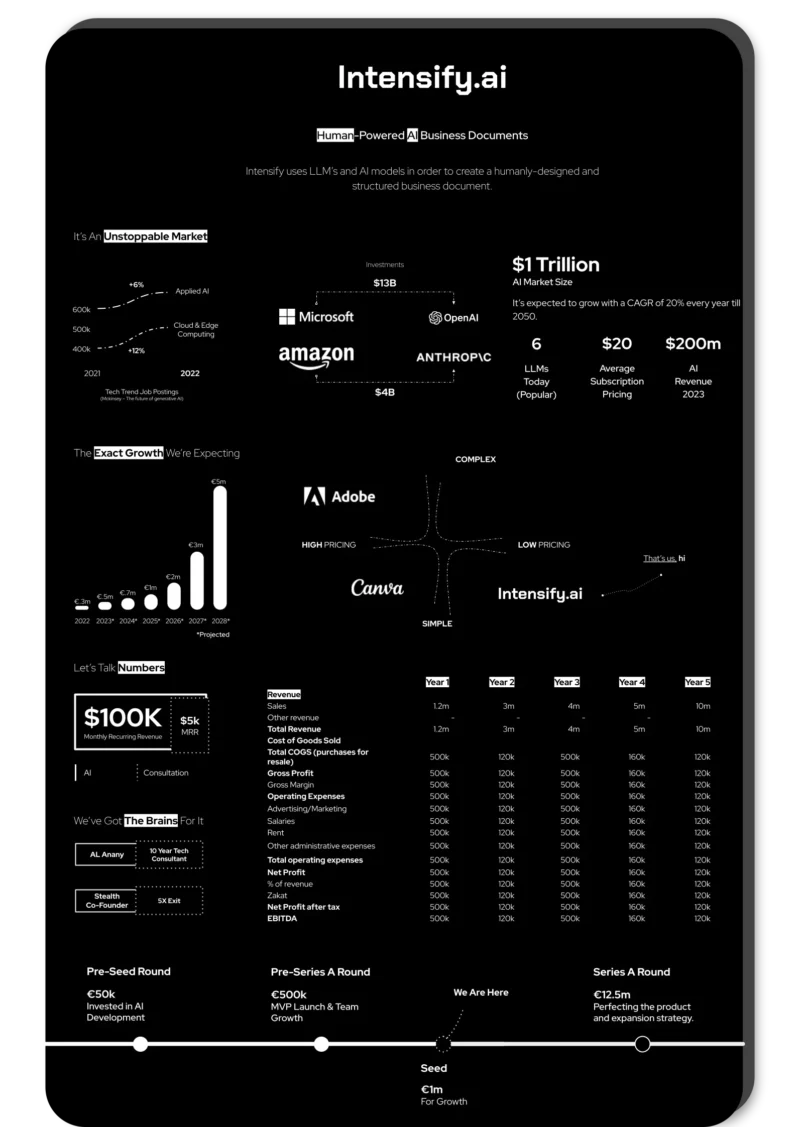

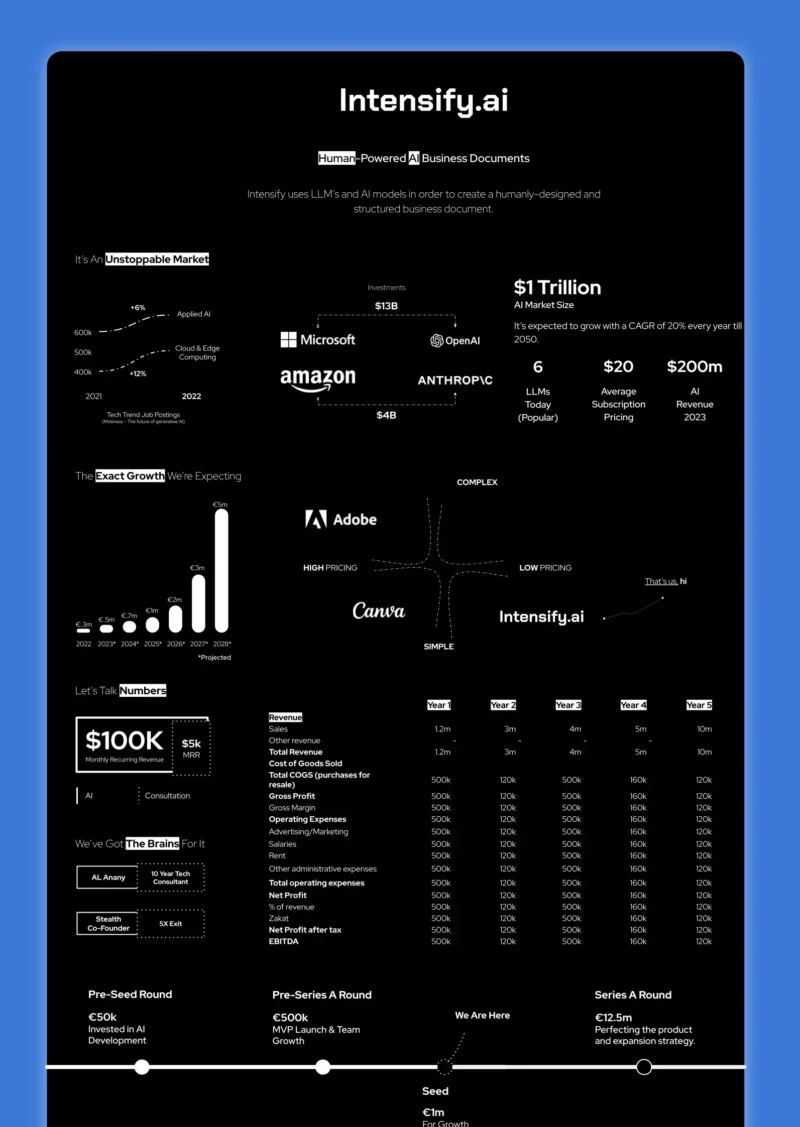

Meet The Author Of This Article

I’m Al Anany, the founder and CEO of Albusi.

Having studied the KSA market for a very long time, I can assure you that it won’t be a walk in the park. But it’ll be worth it.