Real estate investment trusts jobs are in high demand. Yet, It’s closely connected to where you sitting right now, a property.

Your family probably did it. Your non-risky friends are doing it. That is investing in real estate. It‘s land, which is always in demand, right? (We will just ignore the housing bubble in this context.)

If you give one million dollars to a random stranger and ask them to invest it in something of their choice, one of their first ten investment methods will probably be real estate.

To the moderately risky, it will be the first choice. To the extremely risky, it will be the tenth. Yet, to the average low-risk investor, it will be somewhere in the top middle.

Real estate has always been a preferred investment. Why? Because it’s a simple one. You own a property that you can use at any moment, then sell or rent it. The shelter is one of the basic human needs and won‘t change.

Yet, in previous years, we‘ve witnessed that all investments are never 100% guaranteed. Real estate investments turned out to be catastrophic in some years. The stock market dropped shockingly in other years. Everything comes with a pro and a con. Yet, in terms of establishing itself as an investment, real estate is doing quite a magnificent job.

So then you must ask yourself, how do people invest in real estate? Do they just contact a broker to buy a place and then rent it out or flip it? Or do they go to a real estate company that acts as a broker? Do they go to the house owner directly? Maybe they just go to a property with a wooden stick and claim it as theirs?

REITs—The Organized Way

Now is when you should know about REITs. A real estate investment trust (REIT) is a company that is focused on working in this real estate area. They could purchase, lease, or fund real estate projects. In other words, their bible says real estate and their day-to-day operations make it happen. The main objective—make money in real estate with collected funds.

Let‘s role-play. You find a house near your neighborhood costing a whopping $500,000. You then think of how you could purchase it and use it to generate income. But, unfortunately, you do not have $500,000. You estimate you will earn $100,000 per year from renting it out over the next ten years. Hence, in ten years, your ROI would be 100% (this is a simple example omitting a lot of variables.)

So you tell your friends that you need to collect $500,000 and pay them a small profit from this 100% ROI each year. They won‘t own the property, you will. They will only make a collective profit of $400,000. The last $100,000 is all yours.

You are acting as a REIT, more or less. Your objective is to generate a steady income stream for your investors (or friends in our example.)

Finally, most REITs are public companies, similar to Apple. But instead of selling iPhones, they do their real estate magic. This makes it easier for the average investor to invest without committing to any property purchasing agreement. You could say that they are investing in the real estate market’s performance.

Let‘s talk numbers.

To determine whether real estate investment trusts jobs are worth it, we need to talk numbers. So let‘s say you chose to invest in a REIT a couple of years ago. Here‘s how much return you would‘ve had on average from a REIT stock.

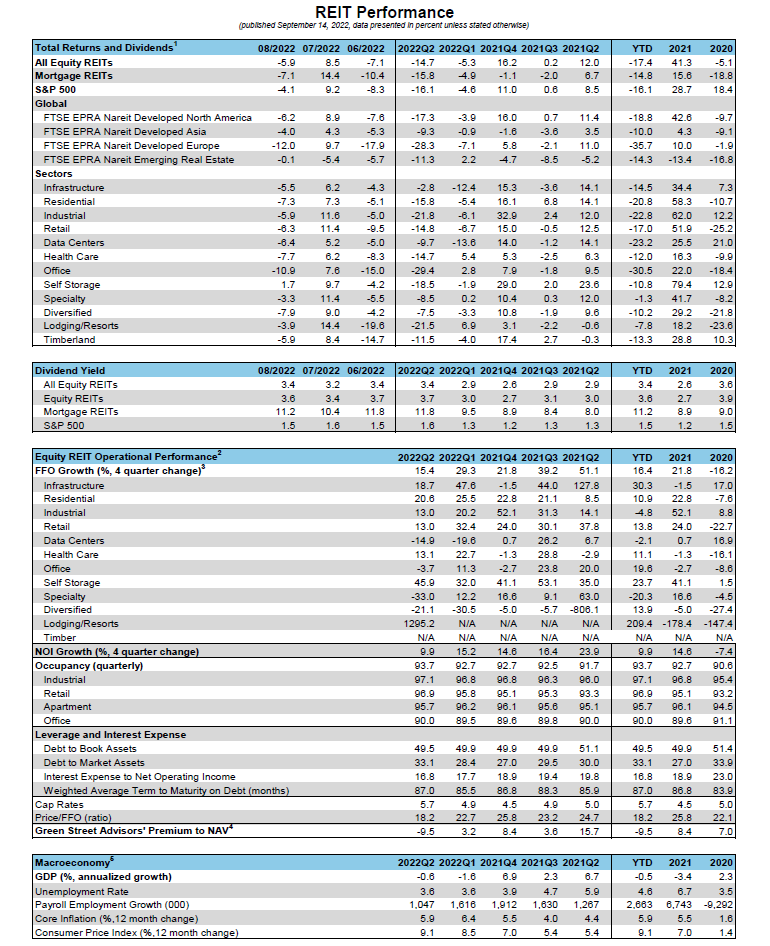

What‘s vital to note from this table is the REIT’s performance vs the S&P 500, specifically in terms of dividends. This is mainly because a REIT has to pay back a minimum of 90% of its taxable income in dividends to shareholders each year.

So in terms of diversification, REITs are a good option to think of. Simply, if you had invested $100,000 in a mortgage REIT (a type of REIT), you could‘ve cashed in an 8.9% dividend yield, equivalent to $8,900.

So then, you need to ask yourself — Should you explore real estate investment trusts jobs?

If you intend to do so, you need to know some big players. According to reit.com, five REITs are considered the best workplaces in the industry.

- Camden Property Trust (NYSE: CPT)

- Kimco Realty Corporation (NYSE: KIM)

- American Homes 4 Rent (NYSEMKT: AMH)

- Healthpeak Properties, Inc. (NYSE: PEAK)

- Sun Communities, Inc. (NYSE: SUI)

If you’re interested in working in this industry and this particular company form, then those three would be a good start to explore.

However, if you are thinking—Does this market have a future, or is it doomed? Then you need to observe the market size and growth.

According to ibisworld.com, the REIT US Market size in 2022 is $229.3 billion. The growth in 2022 is in decline, yet that‘s expected since almost all markets are in decline due to the ongoing recession. On average, the REIT industry grew 0.3% per year between 2017 and 2022. Remember, what‘s lucrative about this investment is also the dividend income.

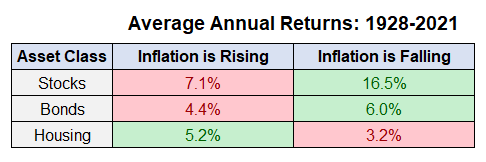

Finally, the last piece of the puzzle is doing an ultimate comparison between bonds, stocks, and the housing market over a long span of time. Thankfully, awealthofcommonsense.com, has such a comparison.

The bond market data isn’t as clear as it is in the stock market. Average returns were higher when inflation was falling but also higher when inflation was above average. The simplest explanation for this discrepancy is the fact that inflation was running above average for much of the 1980s and early-1990s when interest rates were much higher, and interest rates were falling (thus wonderful nominal bond returns).

How much do real estate investment trusts jobs pay?

Of course, we can not know for certain as there are numerous ones. However, we looked into the average salaries of REITs on a few websites:

- Glassdoor—$84,722

- Payscale—$75,000

- Salary.com—$91,537

As you can see, they vary based on the website, but you can grasp the average from those figures.

Are there always going to be jobs in REITs?

The job market in REITs is mostly connected to the real estate market. Hence, as long as the latter exists, then there will always be jobs in REITs.

You could choose to be a part of an established REIT and work with a team. Alternatively, you could also choose to start your own REIT. Yet, if you decide to do the latter, you will have to consult a lawyer, as this takes a lot of paperwork.

Do you need a business plan for a REIT?

Yes! go buy one from one of our freelancers. (Gosh, that sounds lame.)

Alright, so the truth is if you intend to have a REIT, then you need a strong financial plan and even stronger market research. Think of it, what are the elements that will affect your company‘s performance? The market and your dividend estimation and financials.

Hence, we advise you to conduct thorough market research combined with a financial plan that would open your eyes to whether it‘s a good idea with the capital you have or it isn‘t.

This hybrid of a plan should be able to answer the questions:

- What is the market expected to look like in the upcoming 5 years?

- What should my starting capital be?

- How much is it expected to grow?

- What‘s the projected return for the shareholders.

If you know someone to do this for you, then go for it! Yet, if you don‘t, you have a few options to hire a financial analyst and researcher.

- Connections of people you know.

- Freelancing websites like Fiverr and Upwork

- Our own freelancing website, Albusi. (It‘s similar to the second option, but we are only focused on business material.)

Oh, and if you choose to work with one of our freelancers, here is the first step you could do: focused market research.

References

Meet The Author Of This Article

I’m Al Anany, the founder and CEO of Albusi.

Writing in the business industry has shifted my mentality toward entrepreneurship. I started on Medium in 2021 and ended up being a Top Writer of more than 4 categories and had my content viewed more than 213k times.

I always have a single goal while writing: focus on entertaining while adding value.